Loading

Get Cs Form 2030 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CS Form 2030 online

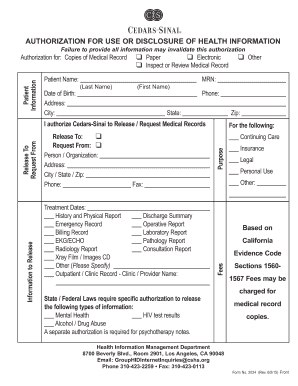

This guide provides clear instructions on how to complete the CS Form 2030 online. Properly filling out this form is essential for ensuring the accurate release and management of health information.

Follow the steps to fill out the CS Form 2030 accurately

- Press the ‘Get Form’ button to access the form and open it in your designated editor.

- Begin by entering the patient's name, including the last name and first name, as well as their date of birth, address, city, state, and zip code.

- Provide the patient's phone number and indicate if you are authorizing Cedars-Sinai to release or request medical records by checking the appropriate option.

- Specify the purpose for the release of information—options may include continuing care, insurance, legal, personal use, or other.

- Clearly indicate the name of the person or organization to whom the records will be released or from whom the records will be requested, including their address, city, state, zip code, and phone number.

- If applicable, check the specific types of health information that will be released, such as mental health records or HIV test results.

- Select the relevant treatment dates and types of records requested, such as history and physical reports or laboratory reports.

- Fill in the patient information section, including the medical record number (MRN) if known.

- Specify your delivery instructions, such as whether records should be mailed or if the requestor should be called when records are ready for pickup.

- Provide your signature, date it, and include your relationship to the patient if you are signing on their behalf.

- Review the information carefully to ensure accuracy, then save the changes, and choose to download, print, or share the completed form.

Complete your health information request online for a smoother process.

Related links form

The 183 days tax rule in Singapore states that individuals who stay in the country for 183 days or more during the calendar year may be considered tax residents. Tax residents enjoy several tax benefits, including lower tax rates and exemptions. If you are navigating tax obligations, using CS Form 2030 can provide clarity on how this rule affects your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.