Get Ced Form 1042 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CED Form 1042 online

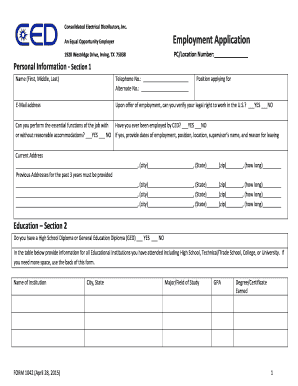

Filling out the CED Form 1042 online can streamline your application process for employment with Consolidated Electrical Distributors, Inc. This guide provides clear instructions to help you complete each section accurately and confidently.

Follow the steps to fill out the CED Form 1042 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section 1, Personal Information. Fill in your full name, telephone number, and alternate contact number. Provide your email address and indicate whether you can verify your legal right to work in the U.S. Next, specify the position you are applying for and whether you have previously worked with CED. Answer whether you can perform the essential functions of the job with or without reasonable accommodations.

- Proceed to Section 2, Education. Indicate if you have a high school diploma or GED. Then, list all educational institutions attended, including the field of study, GPA, and the degree or certificate earned in the provided table.

- Move on to Section 3, Employment History. Detail your work experience over the past 10 years in chronological order. Include the name and address of each employer, your job title, job responsibilities, dates of employment, and reasons for leaving. Ensure to explain any gaps in employment as required.

- In Section 4, Driving Information, provide your driver’s license number, state of issue, and expiration date. Answer the questions regarding your commercial driver's license and any license suspensions or denials. Additionally, include details about past accidents and traffic citations if applicable.

- Section 5, Drivers of Commercial Motor Vehicles, is for applicants with relevant experience. Indicate if you have or can obtain the necessary certificates. Skip this section if not applicable.

- Continue to Section 6, Special Skills. List any relevant skills or certifications that enhance your qualifications for the position.

- Provide details for at least three references in Section 7. Include their names, relationships, how long you have known them, their contact numbers, and addresses.

- In Section 8, answer the question regarding any felony or misdemeanor convictions in the past seven years and provide explanations where required.

- Finally, read and sign the Notifications/Certification section in Section 9 to verify that all provided information is accurate. Include your signature and date.

- Once you have filled out the form completely, ensure that you review your entries for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Start completing your application online today to take the next step toward your future with Consolidated Electrical Distributors, Inc.

To upload the CED Form 1042 to TurboTax, first navigate to the section for uploading tax documentation within the software. Ensure you have the correct file format and follow the prompts provided by TurboTax. This method simplifies the process of including your 1042 in your overall tax submission. Using platforms like uslegalforms can simplify your understanding of these steps.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.