Get How To Correctly Fill Out A Wh-347 Payroll Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the How To Correctly Fill Out A WH-347 Payroll Form online

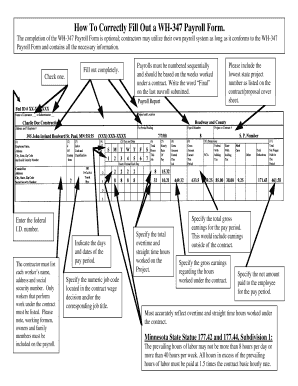

The WH-347 Payroll Form is essential for contractors to report employee wages and work classifications. This guide will assist you in accurately completing the form online, ensuring compliance and clarity in your payroll submissions.

Follow the steps to accurately fill out the WH-347 Payroll Form.

- Click ‘Get Form’ button to access the Payroll Form and open it for editing.

- Fill out all highlighted fields completely. Begin by checking the appropriate box to indicate whether you are using the WH-347 or your own payroll system that complies with the requirements.

- Enter the federal I.D. number in the designated field to identify your business.

- List each worker’s name, address, and social security number in the appropriate sections. Ensure that only workers performing work under the contract are listed, including working foremen, owners, and family members.

- Indicate the days and dates of the pay period in the specified format.

- Specify the numeric job code from the contract wage decision or enter the corresponding job title.

- Number the payrolls sequentially according to the weeks worked under the contract. Mark the final payroll as ‘Final’ to signify the last submission.

- Input the total overtime and straight-time hours worked on the project, ensuring accurate reporting.

- Include the lowest state project number as stated in the contract or proposal cover sheet.

- Specify the total gross earnings for the pay period, including any earnings outside of the contractual work.

- Specify the net amount paid to each employee for the pay period, ensuring it accurately reflects all hours worked.

- For employees performing multiple job duties, use separate lines on the payroll report to distinguish different job classifications.

- When dealing with registered apprentices, include their specific I.D. number, the pay scale, and a copy of the apprenticeship agreement if necessary.

- When finished, review all entries for accuracy, then save changes, download a copy, or print the form for your records.

Complete your WH-347 Payroll Form online today to ensure timely and accurate payroll submissions.

Creating a payroll checklist begins with identifying all necessary tasks, such as collecting employee timesheets, calculating payroll, and verifying deductions. Next, arrange these tasks in a logical order to guide you through each payroll cycle. Utilizing a checklist not only streamlines your process but also reinforces your understanding of how to correctly fill out a WH-347 Payroll Form, ensuring that no steps are overlooked.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.