Loading

Get Tsp-60-r 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-60-R online

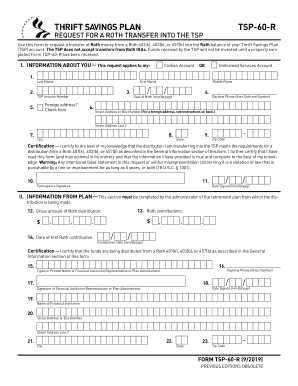

The TSP-60-R form is essential for requesting a transfer of Roth money into your Thrift Savings Plan (TSP) account. This guide provides clear, step-by-step instructions to ensure you can complete the form accurately and efficiently.

Follow the steps to successfully complete the TSP-60-R form online

- Press the ‘Get Form’ button to access and open the TSP-60-R form in your preferred online editor.

- In Section I, select whether your request applies to your civilian account or uniformed services account by checking the appropriate box.

- Fill in your personal information, including your last name, middle name, and first name in the designated fields.

- Next, enter your TSP account number and date of birth in the specified formats.

- If applicable, indicate if you have a foreign address by checking the related box and provide the street address, city, and other requested information accordingly.

- Enter your daytime phone number to ensure the TSP can contact you if needed.

- Review the certification statement carefully, confirming that the distribution meets the requirements and sign and date the form in Items 10 and 11.

- After completing Section I, provide the form to your retirement plan administrator to complete Section II.

- In Section II, the administrator will fill in the gross amount of the Roth distribution, Roth contributions, and relevant certification details.

- Ensure all parts of the form are complete and return it along with a check made payable to the Thrift Savings Plan, ensuring your name and TSP account number are indicated.

- Finally, save any changes you have made, and download, print, or share the completed TSP-60-R form as needed.

Start completing your documents online today to ensure a smooth transfer process.

A TSP 60 form is a specific document used to initiate a rollover from your TSP account to another retirement account. This form ensures that your transfer complies with IRS rules, helping you avoid unnecessary taxes and penalties. Completing this form accurately is essential for a smooth transition. The uslegalforms platform can assist you in accessing and filling out the TSP 60 form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.