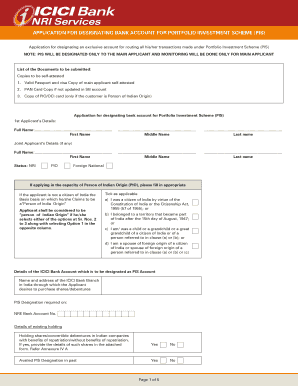

Get Icici Bank Application For Designating Bank Account For Portfolio Investment Scheme (pis)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) online

How to fill out and sign ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Are you still looking for a quick and convenient tool to fill out ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) at a reasonable cost? Our platform offers you a rich collection of forms that are available for submitting on the internet. It takes only a couple of minutes.

Keep to these simple instructions to get ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) ready for sending:

- Select the sample you need in our collection of legal templates.

- Open the form in the online editor.

- Read the instructions to determine which information you will need to give.

- Click the fillable fields and add the required data.

- Put the date and place your electronic signature as soon as you complete all of the fields.

- Examine the completed form for misprints as well as other errors. In case there?s a need to change something, our online editor along with its wide range of instruments are at your disposal.

- Download the resulting template to your device by hitting Done.

- Send the electronic document to the intended recipient.

Filling out ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) doesn?t really have to be complicated any longer. From now on easily get through it from your apartment or at your business office from your smartphone or personal computer.

How to edit ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS): customize forms online

Your quickly editable and customizable ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) template is within reach. Make the most of our library with a built-in online editor.

Do you postpone completing ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) because you simply don't know where to begin and how to proceed? We understand how you feel and have an excellent tool for you that has nothing nothing to do with fighting your procrastination!

Our online catalog of ready-to-use templates allows you to sort through and choose from thousands of fillable forms adapted for various purposes and scenarios. But getting the file is just scratching the surface. We offer you all the needed tools to fill out, certfy, and change the document of your choice without leaving our website.

All you need to do is to open the document in the editor. Check the verbiage of ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) and confirm whether it's what you’re looking for. Begin completing the form by using the annotation tools to give your document a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and fix the existing text.

- If the document is meant for other users too, you can add fillable fields and share them for other parties to fill out.

- Once you’re through completing the template, you can download the document in any available format or pick any sharing or delivery options.

Summing up, along with ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS), you'll get:

- A robust set of editing} and annotation tools.

- A built-in legally-binding eSignature functionality.

- The ability to create forms from scratch or based on the pre-drafted template.

- Compatibility with various platforms and devices for greater convenience.

- Numerous options for protecting your files.

- A wide range of delivery options for more frictionless sharing and sending out files.

- Compliance with eSignature frameworks regulating the use of eSignature in online operations.

With our professional solution, your completed forms are usually legally binding and fully encoded. We make sure to shield your most vulnerable information and facts.

Get what is needed to create a professional-searching ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS). Make the best choice and check out our foundation now!

RBI has authorised only designated branches of a bank to administer the PIS. To open a Zerodha account, NRIs must have a PIS account with any one of the following banks: IDFC First, Yes bank, Axis, HDFC or IndusInd bank. NRIs who do not have a PIS letter can open an NRO Non-PIS account to invest through Zerodha.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.