Get Icici Bank Application For Designating Bank Account For Portfolio Investment Scheme (pis)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) online

Filling out the ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) online is a straightforward process designed to facilitate your investment activities. This guide provides a step-by-step approach to completing the application with ease and accuracy.

Follow the steps to successfully complete the application process:

- Press the ‘Get Form’ button to acquire the ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS) and open it in the provided editor.

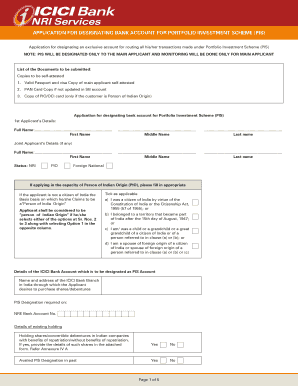

- Begin filling out the first section, which requires the full name of the main applicant. Include fields for first name, middle name, and last name.

- If applicable, provide the full name of any joint applicant in the designated area, along with their status (NRI, PIO, or foreign national).

- Select the basis for claiming to be a Person of Indian Origin (PIO) by ticking the relevant options listed in the form.

- Provide the details of the ICICI Bank account that will be designated as the PIS account, including the branch name and address in India.

- State whether you hold shares or convertible debentures in Indian companies, and if so, provide additional details as specified. Attach any necessary forms as indicated.

- Complete the declarations section by acknowledging that all information provided is accurate to the best of your knowledge and that you understand the terms related to your investments.

- Ensure your application includes all necessary documents for self-attestation, such as a valid passport, visa copy, PAN card, or PIO/OCI card, if applicable.

- Review the checklist provided to confirm that your form is completely filled out and that all required documents are included before submission.

- Once all sections are completed, you can choose to save changes, download, print, or share the application form as needed.

Start your application process for the ICICI Bank PIS online today!

Personal investment rules guide NRIs on how to invest in Indian securities within the legal framework. These rules help ensure that investments are made in a controlled and lawful manner, particularly through accounts like those set up using the ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme. These guidelines not only protect investors but also maintain the integrity of the market.

Fill ICICI Bank Application for Designating Bank Account for Portfolio Investment Scheme (PIS)

Portfolio Investment Scheme. Accounts. Fill out the PIS application form. All the NRIs can only have one PIS account with any designated bank branch and the main objective of this account is to have secondary market transactions. You need to apply for a PIS account through a bank where you hold a Non-Resident account. What would be the procedure to accomplish this PIS transfer from ICICI to YEs Bank when I visit India? Would I be required to sell my shares? You need to visit an RBI-authorised bank branch that provides PIS services. Portfolio Investment Scheme. Click here to Know what is PIS account is in detail. All transactions under.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.