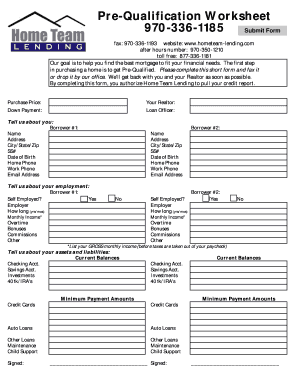

Get Home Team Lending Pre-qualification Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Home Team Lending Pre-Qualification Worksheet online

Completing the Home Team Lending Pre-Qualification Worksheet is a crucial step in your home buying journey. This guide provides clear instructions to help you efficiently fill out the form online, ensuring you provide all necessary information.

Follow the steps to complete the Pre-Qualification Worksheet online.

- Click ‘Get Form’ button to access the worksheet and open it in your preferred editor.

- Begin by entering the purchase price of the home you are interested in. This is the amount you plan to offer for the property.

- Provide your realtor's name and contact information to facilitate communication regarding your pre-qualification.

- Indicate the amount of your down payment. This amount is typically expressed as a percentage of the home's purchase price.

- Fill out the section with your personal information, starting with Borrower #1. Enter their name, address, city/state/zip, social security number, date of birth, home phone, work phone, and email address.

- Repeat step 5 for Borrower #2, if applicable, ensuring that you provide the same details as required.

- In the employment section, indicate whether Borrower #1 and Borrower #2 are self-employed. If yes, provide the employer's name and duration of employment.

- List the gross monthly income for both borrowers. Include any overtime, bonuses, commissions, and any other relevant income sources.

- Detail your assets by providing current balances for checking accounts, savings accounts, investments, and retirement accounts (401k/IRA's).

- Next, outline your liabilities by listing minimum payment amounts for credit cards, auto loans, and any other loans, including maintenance and child support obligations.

- Finally, ensure both Borrower #1 and Borrower #2 sign the form to authorize Home Team Lending to pull credit reports and confirm that all information provided is accurate.

- Once you have completed all sections, save your changes, and you can either download, print, or share the form as necessary.

Start completing your Home Team Lending Pre-Qualification Worksheet online today!

Yes, it is possible to be denied for a mortgage after being pre-qualified using the Home Team Lending Pre-Qualification Worksheet. Pre-qualification gives you an estimate of how much you can borrow based on your financial information, but it is not a guarantee of approval. Factors such as credit history, income verification, and debt-to-income ratio play significant roles in the final decision. Therefore, it’s important to address any concerns early in the process to improve your chances.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.