Loading

Get Mac 1065 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mac 1065 online

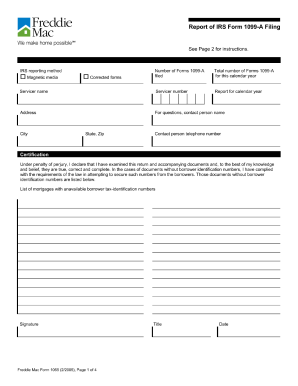

The Mac 1065 form, also known as Freddie Mac Multifamily Form 1065M, is pivotal for servicers to report IRS Forms 1099-A and 1099-C submissions. This guide will help users fill out the form accurately and efficiently, ensuring compliance with IRS regulations.

Follow the steps to complete the Mac 1065 online.

- Press the ‘Get Form’ button to obtain the form and access it in the editor.

- Fill in the servicer name, number, and address in the appropriate fields. Ensure accurate details for effective communication.

- Enter the total number of Forms 1099-A and 1099-C submitted for the calendar year.

- Provide contact information, including the name, city, state, and telephone number of a person for inquiries.

- Indicate the reporting calendar year in the designated field.

- Certify the accuracy of the information provided by signing the form, including inserting your title and the date.

- Provide a list of mortgages that do not have borrower tax identification numbers, if applicable.

- Once all fields are filled out correctly, save your changes, download the completed form, and prepare for printing or sharing as needed.

Complete your Mac 1065 form online for streamlined submissions.

The Schedule B-1 form associated with the Mac 1065 is used to provide additional detail about partners of the partnership. This form is crucial for the IRS to verify partner information and their respective shares of income. Filing this form accurately helps maintain transparency and compliance with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.