Get Dsfcu Loss Mitigation Borrower Response Package Modification 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DSFCU Loss Mitigation Borrower Response Package Modification online

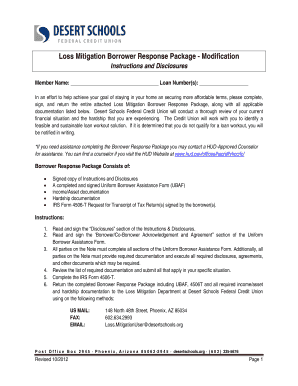

Completing the DSFCU Loss Mitigation Borrower Response Package Modification is essential for users seeking to secure more affordable loan terms. This guide provides a clear pathway to filling out the required forms and documents online, ensuring all necessary information is submitted correctly and timely.

Follow the steps to successfully complete the online form.

- Press the ‘Get Form’ button to access the Loss Mitigation Borrower Response Package Modification form and open it in your preferred online document editor.

- Read and sign the ‘Disclosures’ section at the beginning of the form. Ensure that all provided information is clear and accurate.

- Locate and fill out the ‘Borrower/Co-Borrower Acknowledgment and Agreement’ section in the Uniform Borrower Assistance Form. Both individuals must sign this section.

- Ensure that all parties listed in the loan agreement complete every section of the Uniform Borrower Assistance Form thoroughly.

- Gather and prepare all necessary documentation required for your specific situation. This may include income/asset documentation and hardship explanations.

- Complete the IRS Form 4506-T, ensuring all required information is filled accurately. This form is critical for tax return verification.

- Compile the entire Borrower Response Package, which should include the signed UBAF, the completed IRS Form 4506-T, and all applicable income and hardship documentation.

- Return the completed package to the Loss Mitigation Department. You may submit it via the following methods: US Mail, Fax, or Email as indicated.

- After submission, save any changes to your form and consider downloading or printing a copy for your records.

Complete your DSFCU Loss Mitigation Borrower Response Package Modification online today for a smoother path to loan assistance.

To get approved for loss mitigation, start by gathering all relevant financial documents and completing the necessary forms accurately. Submitting a compelling hardship letter alongside the DSFCU Loss Mitigation Borrower Response Package Modification increases your chances of approval. Remember, clear communication with your lender throughout this process is essential for achieving a positive outcome.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.