Loading

Get Dcu Form M727a 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DCU Form M727a online

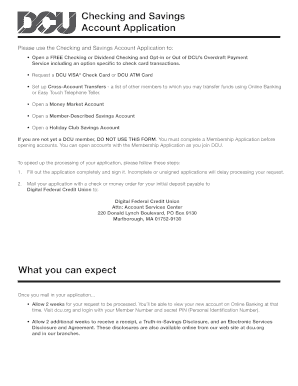

Filling out the DCU Form M727a online is an essential step in opening your checking or savings account. This guide provides you with clear instructions to complete the form accurately and efficiently, ensuring your application is processed without delay.

Follow the steps to successfully complete the online DCU Form M727a.

- Click 'Get Form' button to access the DCU Form M727a and open it in your preferred online editor.

- Begin filling out the form by providing your legal name and DCU member number if applicable. Include your Social Security Number and Date of Birth in the specified fields.

- Enter your residential address in the designated section, ensuring it is current and accurate.

- Select the accounts and services you wish to open or request by checking the corresponding boxes for either 'Self' or 'Joint' accounts. Specify your initial deposit amounts in the given fields.

- If opting for overdraft services, choose among the provided options for overdraft payment service, ensuring you understand the implications of each choice.

- For any Cross-Account Transfers, list the member numbers for other accounts to which you may transfer funds.

- Complete the Joint Owner Information section if applicable, providing all required details for the joint owner.

- Read and sign the agreement section to confirm your request for the services and that the information provided is truthful. Joint owners must also sign if applicable.

- After completing the form, review all entries for accuracy. Once satisfied, you can save your changes, download the form, or print it for your records.

Take action now and fill out your DCU Form M727a online to get started on opening your new account.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A VOD letter, or Verification of Deposit, confirms the balance and status of your account. This document may be necessary when filling out the DCU Form M727a or applying for loans. Typically, you can request this letter from your bank, which helps substantiate your financial position.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.