Loading

Get Cfpb Loan Estimate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CFPB Loan Estimate online

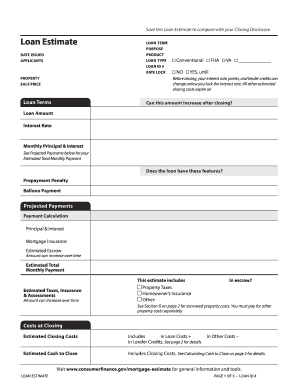

Completing the CFPB Loan Estimate online is an essential step in the mortgage process. This guide will provide you with clear, step-by-step instructions to help you accurately fill out the form, ensuring you understand the key components and implications of your loan.

Follow the steps to complete your Loan Estimate with ease.

- Press the ‘Get Form’ button to access the Loan Estimate and open it in your form editor.

- Fill in the loan term by selecting the duration of the loan, such as 30 years, from the loan term section.

- Indicate the purpose of the loan, typically marked as 'Purchase' if you are buying a home.

- Select the loan product type, such as Conventional, FHA, or VA, from the provided options.

- Complete the loan ID number, which uniquely identifies your loan application.

- Specify if you would like to lock in the interest rate by selecting 'YES' or 'NO' in the rate lock section.

- Enter the date issued for your loan estimate, which is typically the date you are filling out the form.

- List the applicants' names in the area designated for names of all individuals applying for the loan.

- Provide the property address where the loan will be secured and the estimated property value.

- Input the loan amount you wish to borrow and the initial interest rate offered.

- Review the monthly principal and interest calculations, including any projected payment calculations and monthly estimates.

- Complete the costs at closing section, which details estimated closing costs and cash to close amounts.

- Finalize by saving your completed Loan Estimate. You can also choose to download, print, or share the form for future reference.

Complete your CFPB Loan Estimate online today to streamline your mortgage process.

The CFPB implemented a rule requiring all lenders to provide you with a loan estimate within three days of completing a loan application. The three-day rule is mandatory, and lenders who don't follow it can be subject to regulatory action and fines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.