Get Campus Partners Forbearance Request 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Campus Partners Forbearance Request online

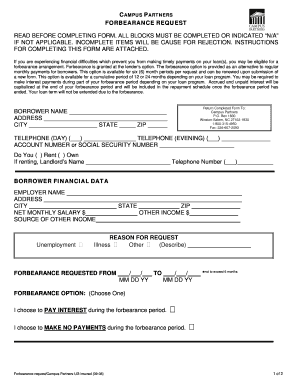

Navigating financial difficulties can be challenging, and seeking a forbearance request may provide the relief you need. This guide outlines the steps for filling out the Campus Partners Forbearance Request online, ensuring you understand each section of the form.

Follow the steps to complete your forbearance request.

- Press the ‘Get Form’ button to obtain the form and open it in your document editor.

- Complete all blocks in the form. Each field must be filled out or marked as 'N/A' if it does not apply to your situation. Incomplete forms may be rejected.

- Enter your personal details, including your name, address, city, state, zip code, and contact telephone numbers. Include either your account number or social security number.

- Indicate your housing situation by selecting whether you rent or own your home, and if applicable, provide your landlord’s name and contact information.

- Provide your employment information, including your employer's name, address, and your net monthly salary. Also list any sources of other income you receive.

- Specify the reason for your forbearance request by checking the appropriate box or describing your reason, such as illness.

- Fill in the dates for which you are requesting forbearance; this can be for a maximum of six months.

- Select your forbearance option, either to pay interest during the period or make no payments.

- Attach the required additional documentation, including the most recent 1040 tax return, W-2 forms, and a detailed list of your financial revenues and expenses.

- Sign and date the form. If applicable, also have your cosigner sign, as their signature is required.

- Review the completed form for accuracy, then save your changes. You can download, print, or share it as needed.

Complete and submit your Campus Partners Forbearance Request online to take the next step toward managing your financial situation.

Deciding between deferring and forbearance largely depends on your financial situation and future plans. If you can resume payments in a few months, deferring might be a better option. On the other hand, a forbearance request offers flexibility if you need more time. Whichever you choose, consider the benefits of the Campus Partners Forbearance Request for tailored options.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.