Loading

Get Bad Debt Write-off Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bad Debt Write-off Worksheet online

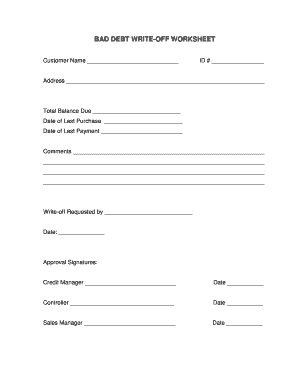

Filling out the Bad Debt Write-off Worksheet online is an essential process for managing uncollectable debts efficiently. This guide provides clear, step-by-step instructions to help users complete the form accurately and easily.

Follow the steps to complete the Bad Debt Write-off Worksheet online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the customer name in the designated field for 'Customer Name'. This identifies the person or entity associated with the debt.

- Next, input the customer ID number in the 'ID #' field to uniquely identify the customer within your records.

- Fill in the 'Address' section with the customer's current address to ensure all information is updated for correspondence.

- Enter the 'Total Balance Due' to specify the amount that needs to be written off.

- Document the 'Date of Last Purchase' to provide a reference point for when the debt was incurred.

- Similarly, record the 'Date of Last Payment' to indicate the last recorded payment made by the customer.

- Use the 'Comments' section to provide any additional information relevant to the write-off, which may include reasons or notes regarding the debt.

- In the 'Write-off Requested by' field, enter the name of the individual requesting the write-off for accountability.

- Finally, fill in the date for when the request is made.

- Ensure that all required approval signatures are obtained from the Credit Manager, Controller, and Sales Manager along with their respective dates.

- After completing all fields, review the information for accuracy and save your changes. You can then download, print, or share the form as needed.

Complete your documents online today to streamline your debt management process.

When accounting for bad debts written off, you will need to create a journal entry that reflects the removal of the debt from accounts receivable and acknowledges it as an expense. Accurate record-keeping in a Bad Debt Write-off Worksheet simplifies this process and provides a clear audit trail for future reference.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.