Get Texas Tech University Non-tax Filer Statement 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Tech University Non-Tax Filer Statement online

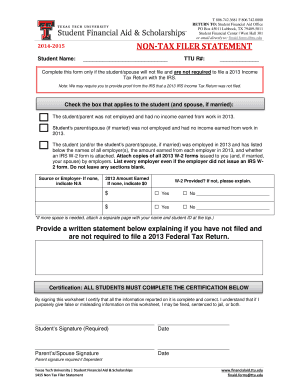

This guide provides clear and comprehensive instructions for completing the Texas Tech University Non-Tax Filer Statement online. Whether you are a student or a spouse who is required to complete this form, the following steps will ensure you navigate the process easily and accurately.

Follow the steps to complete your Non-Tax Filer Statement online.

- Press the ‘Get Form’ button to access the form and open it in the required editor.

- Begin by filling in your full name in the designated 'Student Name' field.

- Enter your Texas Tech University R# in the corresponding section.

- Indicate whether you (and your spouse, if applicable) were employed in 2013. Choose the appropriate box for 'not employed' or 'employed'.

- If employed, list all employers in the 'Source or Employer' section along with the amount earned from each employer in 2013.

- Note whether you have received an IRS W-2 form from each employer by checking the appropriate box.

- If there is no income or no employer, write 'N/A' or '$0' in the respective sections.

- Attach copies of all 2013 W-2 forms received to the completed statement.

- Provide a brief written statement below explaining why you have not filed or are not required to file a 2013 Federal Tax Return.

- Complete the certification section by signing and dating the form. Ensure that if you are a dependent, your parent or spouse also signs and dates the form.

- Once you have filled out all relevant fields, save your changes and download or print a copy of the completed form. You may also share the form as necessary.

Complete your Texas Tech University Non-Tax Filer Statement online today for a smooth submission process.

To obtain the 1098T form from Texas Tech University, students should log into their student account portal, where the form is typically available for download. The 1098T form provides tax information regarding qualified tuition and related expenses, essential for students claiming education tax credits. If you encounter any issues, the university’s financial services office can provide assistance in accessing this important document.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.