Get Asu Fatca Compliant Substitute W-9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ASU FATCA Compliant Substitute W-9 online

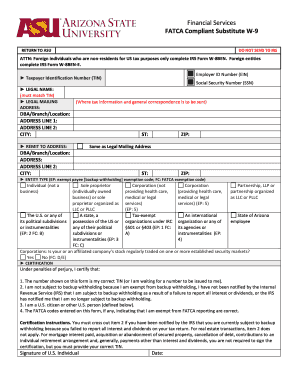

Completing the ASU FATCA Compliant Substitute W-9 is an essential step for individuals and entities to provide accurate tax information. This guide offers clear, step-by-step instructions to help you fill out the form online with ease and confidence.

Follow the steps to complete the ASU FATCA Compliant Substitute W-9 online.

- Click the 'Get Form' button to access the ASU FATCA Compliant Substitute W-9 and open it in your online editor.

- Start by entering your Taxpayer Identification Number (TIN) in the designated field. If you are an individual, this will be your Social Security Number (SSN). Make sure it accurately reflects your legal name.

- Next, provide your legal mailing address. This address will be used for all tax information and correspondence. Include the address line 1, address line 2 (if needed), city, state, and ZIP code.

- If applicable, specify your 'Doing Business As' (DBA) or branch/location name along with the corresponding address and city details. Select 'Same as Legal Mailing Address' if the addresses are the same.

- Indicate your entity type by selecting the appropriate option from the list provided. This includes choices for individuals, corporations, partnerships, and other business structures.

- Answer the question regarding whether your or an affiliated company’s stock is regularly traded on one or more established security markets. Select 'Yes' or 'No' as applicable.

- Review the certification section carefully. Ensure that all statements are true to the best of your knowledge. You will need to check under penalty of perjury that the information provided is accurate.

- Finally, include the signature of the U.S. individual for verification and note the date when signing the form.

- After you have filled out all necessary fields, review the completed form for accuracy. You can then save changes, download, print, or share the form as required.

Complete your ASU FATCA Compliant Substitute W-9 online today for accurate and reliable tax documentation.

FATCA on W-9 refers to the specific compliance requirements for U.S. individuals and entities filling out the IRS Form W-9. It mandates reporting for foreign financial institutions and U.S. account holders to the IRS. Ensuring your form meets these requirements is vital to avoid potential penalties. You can access the ASU FATCA Compliant Substitute W-9 on US Legal Forms to ensure you are fully compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.