Loading

Get Rf1209 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rf1209 online

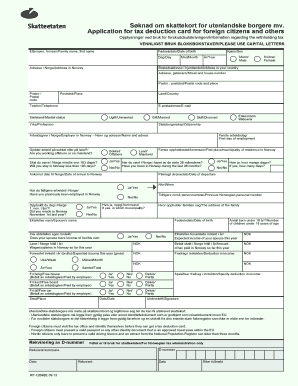

The Rf1209 form is essential for foreign citizens applying for a tax deduction card in Norway. This guide provides clear, step-by-step instructions to help you fill out the form online accurately and efficiently.

Follow the steps to complete your Rf1209 form online.

- Press the ‘Get Form’ button to access the Rf1209 form and open it in the designated online platform.

- Begin by filling out your family name and first name in capital letters as specified by the form.

- Enter your date of birth, ensuring you select the correct day, month, and year.

- Provide your current address in Norway, including street name and number, postal code, and city.

- Indicate your gender by selecting either male or female.

- Fill out your residential address in your home country, including street address, postal code, and city.

- Include your telephone number and email address for contact purposes.

- State your marital status by selecting the appropriate option: unmarried, married, widowed, or divorced.

- Identify your citizenship.

- Provide the name and address of your employer in Norway.

- Indicate your first day of employment.

- Specify whether your work is offshore or on mainland by selecting the correct option.

- Answer whether you will stay in Norway for less than 183 days.

- Indicate if you have been in Norway in the last 36 months.

- Fill out your date of arrival in Norway and your first municipality of residence.

- If applicable, state your planned date of departure.

- Indicate if you have previously worked in Norway and provide any past Norwegian personal number.

- Answer if you resided in Norway on November 1st of the previous year and specify the municipality if yes.

- Provide the address of your family if they reside separately.

- Complete spouse details, including name, date of birth, and whether they have their own income.

- State the number of children under 18 years of age.

- Indicate your spouse's expected income this year, wages in Norway this year, and the amount of tax paid so far.

- If applicable, fill out expected gross income and deductions.

- Specify if you receive free housing, board, or car from your employer.

- Provide additional deductions if necessary.

- Sign the form to confirm that the information provided is accurate.

- After reviewing your entries, save the form, download, print, or share the completed document as needed.

Complete and submit your Rf1209 form online today for efficient processing.

The tax withholding card in Norway determines the amount of tax withheld from your salary before you receive it. Employers use this card to ensure that the correct tax amount aligns with your individual situation. Acquiring this card is vital to avoid any surprises on your income tax return. If you’re applying for one, Rf1209 can help you understand the requirements and processes involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.