Loading

Get No X-0095 E 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NO X-0095 E online

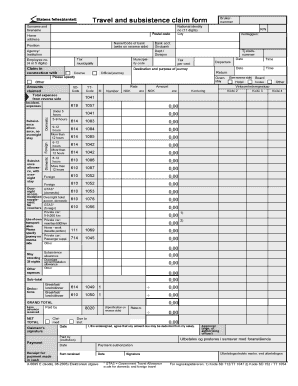

Filling out the NO X-0095 E, a travel and subsistence claim form, can seem daunting. This guide provides step-by-step instructions to help users complete the form with confidence, ensuring all necessary information is accurately submitted.

Follow the steps to complete the NO X-0095 E form efficiently.

- Click 'Get Form' button to access the NO X-0095 E form and open it in your preferred online editor.

- Start by entering your surname and forename in the designated fields. Make sure to provide your full legal name as per your identification documents.

- Input your national identity number, which consists of 11 digits, ensuring accuracy as it is a vital identification reference.

- Fill in your city and postal code to specify your location accurately.

- Provide your home address in the designated area. This should include your street address, apartment number (if applicable), city, and state.

- Enter the name or code of your bank on the reverse side. This will assist in processing any payments related to your claim.

- Indicate your position and the agency or institution you represent. It is important to fill this out correctly as it relates to your employment status.

- In the tax municipality section, provide the name of the municipality where you are registered for tax purposes.

- Fill in your employee number, which consists of 4 or 5 digits, for identification within your institution.

- Detail the claim in connection with the specific events or expenses for which you are seeking reimbursement.

- Next, provide the municipality code that corresponds to your location.

- Indicate the details of your travel expenses, including departure, overnight stays, total expenses, and any incidentals as specified on the reverse side.

- Complete any sections related to subsistence allowances, including meals and overnight accommodations, according to the guided categories.

- Make sure to input total claimed amounts for each category, checking that these figures add up correctly.

- Review the entire form to ensure all fields are filled out accurately and completely before proceeding.

- Once all information is verified, save your changes; you may download, print, or share the completed form as needed.

Complete your NO X-0095 E form online today for a seamless reimbursement process.

Form 8332 is typically completed by the custodial parent, who has the dependent's primary care. This form allows them to release their claim on the child's tax exemption to the non-custodial parent. Accurate completion is critical to ensuring the non-custodial parent can benefit from the exemption. USLegalForms offers solutions to facilitate this process for all parties involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.