Loading

Get Irs 1040 Line 20a

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Line 20a online

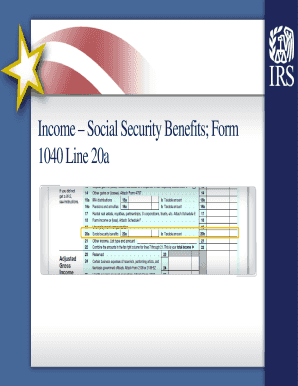

The IRS 1040 Line 20a is crucial for reporting Social Security and railroad retirement benefits. This guide will provide a clear, step-by-step approach to filling out this line of the form online, ensuring users can accurately report their income.

Follow the steps to accurately complete Line 20a of your IRS 1040 form online.

- Click ‘Get Form’ button to obtain the IRS 1040 form and open it in a suitable digital editor.

- Locate Line 20a on the form, which is where you will report your total Social Security and railroad retirement benefits. These totals are typically found on your Form SSA-1099 and Form RRB-1099.

- Determine the taxable portion of the benefits. If these benefits were your only source of income, they are usually not taxable, and you may not need to file. If you had other income, complete the Social Security Benefits Worksheet to calculate the taxable amount.

- For lump-sum benefit payments, choose how you want to report them. You can either report the total payment in the year received or treat it as if received in previous years, which may lower your taxable amount.

- After filling in Line 20a with the appropriate figures, review your entries for accuracy. Ensure all calculations and applicable worksheets have been referenced.

- Once you have completed the form, save your changes, and download or print your completed IRS 1040 form for submission.

Begin filling out your IRS 1040 Line 20a online today for accurate tax reporting.

Related links form

Completing Schedule 2 depends on your unique financial situation. If you have specific types of income, like capital gains or unreported self-employment income, you will need to fill it out for a complete tax return. This is especially important as it has implications for your IRS 1040 Line 20a, ensuring symmetry in your reported income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.