Loading

Get Ec Sri Application Form Of Tax Benefits For Foreign Tourists

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EC SRI Application Form of Tax Benefits for Foreign Tourists online

This guide provides comprehensive instructions on completing the EC SRI Application Form of Tax Benefits for Foreign Tourists online. We aim to make the process clear and accessible for all users, regardless of their prior experience with such forms.

Follow the steps to successfully complete the application form.

- Click 'Get Form' button to obtain the application form and open it in the appropriate online editor.

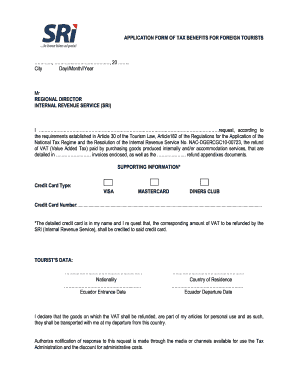

- Fill in the date of your application at the top of the form, using the format Day/Month/Year. Ensure the information reflects the current date accurately.

- Provide the address to which the form is being submitted. Indicate 'City' followed by the name of the city closely related to the tax authority's location.

- Address the form to the Regional Director of the Internal Revenue Service (SRI). Use a professional salutation, such as 'Dear Regional Director'.

- State your request clearly, including reference to Article 30 of the Tourism Law, the relevant regulations, and the specific resolution under which you are applying for a VAT refund on eligible purchases and services.

- In the Supporting Information section, select the appropriate credit card type (VISA, MasterCard, Diners Club) and enter the corresponding credit card number. Ensure this card is in your name, as the refund will be credited there.

- Complete the Tourist’s Data section by providing your nationality, country of residence, and the dates of your entry and departure from Ecuador.

- Declare that the items for which you are requesting VAT refunds are for personal use and confirm that they will be taken with you upon your departure.

- Read and agree to the Agreement of Responsibility and Use of Electronic Media. This section outlines the terms under which you will receive notifications regarding your application.

- Sign the form where indicated, including your passport or ID number, verifying that the information is accurate and that you accept the responsibilities outlined in the agreement.

- Once all fields are completed and verified, you may save your changes, download a copy for your records, print the completed form, or share it as needed.

Complete your EC SRI Application Form online today to take advantage of tax benefits for foreign tourists.

Indeed, tourists can often get tax back on shopping in the USA, depending on the state where the purchases were made. Be sure to keep track of your receipts and utilize the EC SRI Application Form Of Tax Benefits For Foreign Tourists for an effective claim process. Each region has its own rules, so understanding these requirements is crucial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.