Get Dutch Banking Association Self-certification Form To Establish Foreign (tax) Status 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dutch Banking Association Self-Certification Form to Establish Foreign (Tax) Status online

Filling out the Dutch Banking Association Self-Certification Form is essential for establishing foreign tax status. This guide offers a clear and comprehensive walkthrough to help users complete the form thoroughly and accurately, facilitating compliance with tax regulations in a professional manner.

Follow the steps to fill out the form effectively.

- Click the 'Get Form' button to access the form and open it in your preferred editing tool.

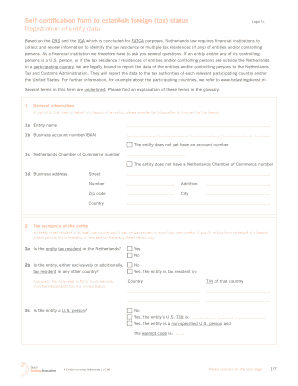

- Begin with the 'General Information' section. Here, you will need to enter the entity name, business account number (IBAN), Chamber of Commerce number, and business address, including street, zip code, city, and country. If the entity does not have an account number or a Chamber of Commerce number, indicate that accordingly.

- Proceed to 'Tax Residence of the Entity' section. Answer whether the entity is tax resident in the Netherlands by selecting 'Yes' or 'No'. If applicable, provide details of any other tax residency in countries outside the Netherlands and the U.S., including the Taxpayer Identification Number (TIN) for that country.

- Next, determine if the entity is considered a U.S. person or a financial institution. Provide any relevant information based on previous questions.

- Complete the 'Information on the Non-Financial Entity' section. Assess the percentage of gross income that is passive income and provide details about the entity's operating status.

- If applicable, provide information regarding controlling persons in the entity. This includes first and last names, dates of birth, residence addresses, tax residency, and whether they qualify as U.S. persons.

- Finally, review the 'Declaration and Signature' section. An authorized representative must sign and date the form, confirming the accuracy of the information provided. Ensure all required signatures are included before submission.

To ensure compliance, complete the Dutch Banking Association Self-Certification Form online today!

You may have received a FATCA form because your bank or financial institution is required to comply with U.S. tax regulations. This form helps determine your foreign account status and related tax obligations. If you need assistance in completing it, the Dutch Banking Association Self-Certification Form to Establish Foreign (Tax) Status is a beneficial resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.