Loading

Get Calstrs Rf1410 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CALSTRS RF1410 online

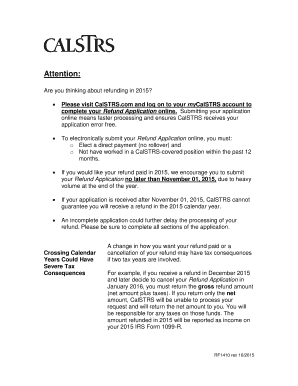

The CALSTRS RF1410 is an essential document for individuals seeking to refund their contributions and interest from their Defined Benefit and Defined Benefit Supplement accounts. This guide will provide you with comprehensive, step-by-step instructions to navigate the online application process effectively.

Follow the steps to complete your refund application online

- Click the 'Get Form' button to obtain the CALSTRS RF1410 form and open it in the online editor.

- Begin filling out Section 1, Member Information. Ensure you provide your full name, Client ID or Social Security number, mailing address, date of birth, telephone number, and email address.

- Move to Section 2, County of Employment. Enter the county in California where you were last employed and the last date of employment.

- Proceed to Section 3, Employer Certification of Employment Termination. If employed in the last 12 months, ensure your employer completes the necessary certification.

- In Section 4, Defined Benefit Payment Instructions, elect whether you want a Direct Payment or a Rollover to a financial institution.

- If you selected a rollover in Section 4, complete Section 4.2 with the financial institution account information for both tax-deferred and after-tax contributions.

- Continue to Section 5, Defined Benefit Supplement Payment Instructions. Choose your distribution method and complete any required financial institution information.

- In Section 6, Tax Withholding Preferences, specify your California state income tax withholding preferences for both Defined Benefit Refund and Defined Benefit Supplement.

- In Section 7, Required Signatures, check the applicable boxes regarding marital status, sign, and ensure the required signatures are completed.

- Finally, in Section 8, read the Special Tax Notice: Your Rollover Options, and confirm that you understand the implications of rolling over your contributions.

- Review your application for any errors. Ensure all necessary fields are completed, then save changes, download, print, or share the application as needed.

Start your refund process today and complete your CALSTRS RF1410 online for faster processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

CalSTRS is regarded as a financially sound pension system. Regular evaluations show that it has a well-structured investment strategy and a strong funding outlook. Staying informed about the financial health of CALSTRS RF1410 can give you peace of mind regarding your retirement plans and security.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.