Loading

Get Capital Stock Increase/decrease Certificate - Oklahoma - Ok 1996-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CAPITAL STOCK INCREASE/DECREASE CERTIFICATE - Oklahoma - Ok online

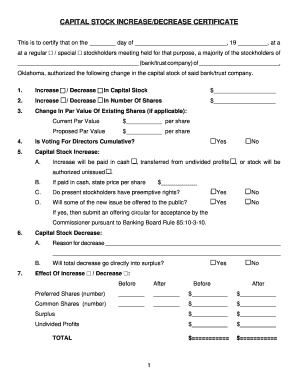

Filling out the Capital Stock Increase/Decrease Certificate is an essential process for banks and trust companies in Oklahoma. This guide will assist you in completing the form confidently and accurately, ensuring you meet all necessary requirements.

Follow the steps to complete the certificate efficiently.

- Use the ‘Get Form’ button to access the Capital Stock Increase/Decrease Certificate and open it in your chosen editor.

- Begin by filling in the date of the stockholders meeting and the name of the bank or trust company at the top of the form. This identifies when and where the decision regarding the capital stock change was made.

- Indicate whether the change in capital stock is an increase or a decrease. Provide the monetary amounts for both the increase or decrease in capital stock and the number of shares, as relevant.

- If applicable, update the current and proposed par value of existing shares. This information is crucial for shareholders to understand the value of their holdings.

- Clarify whether voting for directors will be cumulative by checking 'yes' or 'no' in the respective box.

- For capital stock increases, respond to whether the increase is to be paid in cash, transferred from undivided profits, or if stock will be authorized unissued. State the price per share if paid in cash.

- Determine if present stockholders have preemptive rights and whether any of the new issue will be offered to the public. If it will, a separate offering circular must be submitted.

- For capital stock decreases, provide the reason for the decrease in the allotted space.

- Fill in the total amounts before and after the increase or decrease for preferred shares, common shares, surplus, and undivided profits, ensuring transparency for stakeholders.

- Attach a certified copy of the resolution adopted by the majority of stockholders and a copy of the stockholders' minutes that contain the aforementioned resolution.

- Finally, certify the information as the President or Secretary of the bank or trust company by signing and dating the form, and ensure a notary public witnesses this certification.

- After completing all the sections, save your changes, and choose to download, print, or share the form as needed.

Complete your Capital Stock Increase/Decrease Certificate online today.

In Oklahoma, capital gains are taxed as part of an individual's income tax. Short-term gains are typically taxed at the ordinary income tax rates, while long-term gains often receive preferential treatment. It's wise to familiarize yourself with the process and necessary documentation like the CAPITAL STOCK INCREASE/DECREASE CERTIFICATE - Oklahoma - Ok to ensure compliance and maximize your tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.