Get Ny Dtf It-204-ll 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF IT-204-LL online

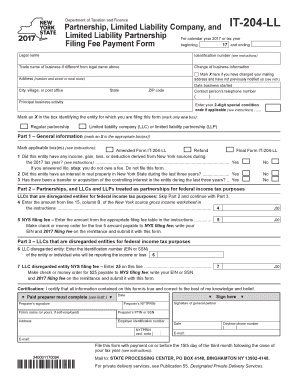

The NY DTF IT-204-LL is a vital form used for reporting income and fees associated with partnerships and limited liability companies in New York State. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring a smooth filing experience.

Follow the steps to fill out the NY DTF IT-204-LL effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the legal name of your partnership or limited liability company in the designated field.

- Provide the identification number as indicated in the form's instructions.

- If your business has a trade name that differs from the legal name, enter it in the respective field.

- Update your address details to reflect the current mailing address, marking the box if you have changed this recently without prior notification.

- Indicate the date your business commenced operations.

- Enter the contact person's telephone number alongside the principal business activity.

- Mark the appropriate box to identify your entity type—either a regular partnership, LLC, or LLP.

- In Part 1, answer the questions about your entity’s income and property interests in New York, marking ‘Yes’ or ‘No’ as applicable.

- If applicable, input the amount from the worksheet as instructed, and calculate the New York State filing fee based on the provided tables.

- For LLCs treated as disregarded entities, enter their identification number and filing fee as required.

- Complete the certification section, ensuring all information is accurate and enter the preparer’s details if applicable.

- Review all entries, then save your changes, download, print, or share the completed form as needed.

Complete your NY DTF IT-204-LL form online seamlessly today.

Get form

NYS IT-204-LL is a tax form specifically for partnerships and limited liability companies in New York State. It reports the income and distribution of profits to the members or partners. Using this form helps ensure that your entity meets state reporting requirements. To make this process easier, consider using uslegalforms to access resources and templates for completing your NY DTF IT-204-LL accurately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.