Loading

Get Nc Bl-5 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC BL-5 online

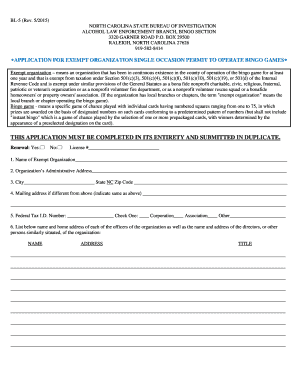

The NC BL-5 form is essential for exempt organizations wishing to operate bingo games. This guide provides comprehensive instructions on how to accurately complete the form online, ensuring a smooth application process.

Follow the steps to complete your NC BL-5 application.

- Click ‘Get Form’ button to access the NC BL-5 application form and open it in the editor.

- Begin by filling in the name of your exempt organization in the designated field. Ensure the name matches your official records.

- Enter your federal tax identification number in the provided field. Indicate the type of organization by checking the corresponding box: Corporation, Association, or Other. Specify the type if 'Other' is selected.

- List the names, home addresses, and titles of each officer of the organization in the available space. If needed, use additional sheets to ensure all information is captured.

- Identify the members of the special committee responsible for managing the bingo games. Include their names, addresses, and telephone numbers as requested.

- For renewal applications, check the appropriate box. Provide a copy of the application for recognition of exemptions and a determination letter from relevant authorities if required.

- Specify the location where the bingo games will be held, including the street address, city, county, state, and zip code.

- Indicate whether the organization owns the premises where bingo games will occur. If the premises are leased, provide the lease or rental agreement.

- Confirm that all provided information is true and accurate in the certification section, including a signature and title of the officer making the application.

- Finally, save your changes. You can download, print, or share the completed form as required.

Complete your NC BL-5 application online today to operate bingo games legally.

Yes, you can file NC-5Q online for convenience and efficiency. Many users appreciate the ease of submitting their forms through electronic platforms. This option not only saves time but also minimizes errors associated with manual submissions. For a smooth experience, you might consider USLegalForms for your filing needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.