Get Il Upa-1003-(f) 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL UPA-1003-(F) online

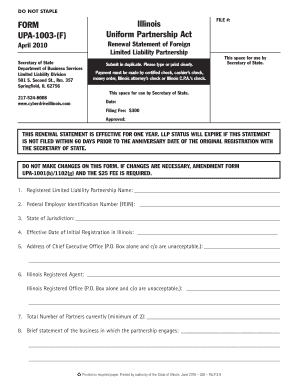

Filling out the IL UPA-1003-(F) form online is an essential process for foreign limited liability partnerships looking to renew their status in Illinois. This guide will walk you through each step of completing the form accurately and efficiently.

Follow the steps to fill out the IL UPA-1003-(F) with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the registered limited liability partnership name in the first field. This name should match the one under which your business is officially registered.

- Provide your federal employer identification number (FEIN) in the designated space. Ensure this is accurate as it is critical for tax identification.

- Specify the state of jurisdiction where your partnership was initially formed. This is important for proper identification of your entity's origin.

- Indicate the effective date of the initial registration in Illinois. If you are unsure, consult your records for the exact date.

- Fill in the address of your chief executive office. Note that a P.O. Box alone and 'c/o' are not acceptable; a physical address is required.

- Input the name and contact information of your Illinois registered agent along with the registered office address, following the same rules concerning P.O. Boxes.

- State the total number of partners in your partnership. Remember, partnerships must have a minimum of two partners.

- Offer a brief statement describing the business activities in which your partnership engages. This description should be clear and concise.

- Confirm your application for continual status as a foreign limited liability partnership as prompted.

- Ensure you attach a Certificate of Good Standing from the appropriate authority in the state or country where your LLP was formed.

- The designated individual must affirm the application is true and accurate by signing the form. Provide their name, street address, and the date of signature. The year should be filled in appropriately.

- Once all fields are completed, review your entries to confirm accuracy before submission. After ensuring the form is complete and correct, save your changes, and you can then download, print, or share the form as necessary.

Complete your form online today to ensure your renewal process is smooth and timely.

The partnership tax rate in Illinois is determined by the income earned by the partnership. Generally, partnerships are not taxed at the entity level; instead, income is passed through to the partners, who report it on their individual tax returns. However, partnerships must still file an IL UPA-1003-(F) return to report income, even if they do not owe tax as an entity. This ensures proper reporting and alignment with state regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.