Loading

Get Il Ra 17.8 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL RA 17.8 online

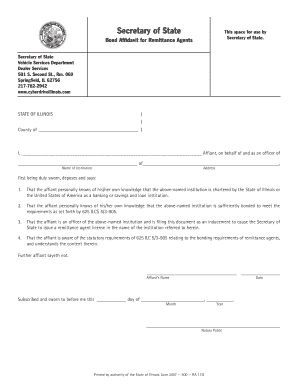

Filling out the IL RA 17.8 form is an essential step for institutions seeking a remittance agent license in Illinois. This guide provides you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the IL RA 17.8 form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In the first section, indicate the county where the institution is located in the blank field labeled 'County of _________________________________________'.

- In the area labeled 'Affiant', provide the full name of the person who is signing the document on behalf of the institution.

- Next, in the field for 'Name of Institution', enter the official name of the institution you are representing.

- Complete the 'Address' field with the full postal address of the institution, including street, city, state, and zip code.

- In the subsequent sections, ensure that the affiant affirms their knowledge of the institution's chartering and bonding requirements as specified by relevant Illinois state laws.

- The affiant must then sign and date the document at the specified lines, ensuring the date is clearly filled in.

- Lastly, ensure that a notary public has signed and sealed the document in the designated area, confirming that the affiant's signature is legitimate.

- Once all fields are accurate and completed, you can save changes to the form, download it, print it, or share it as needed.

Complete your forms online today for an efficient submission process.

To fill out an employee withholding form, specifically the IL-W4 in Illinois, you need to enter your personal details and declare the number of allowances you wish to claim. Follow the specific instructions provided on the form to ensure accurate reporting. For help with the specifics, refer to uslegalforms and ensure you meet the requirements set by IL RA 17.8.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.