Get Il Llc-45.20 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL LLC-45.20 online

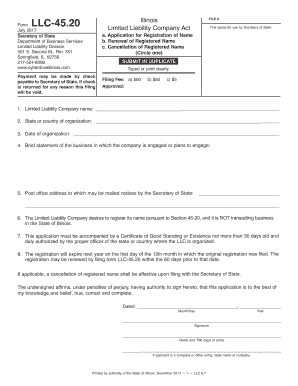

The IL LLC-45.20 form is essential for registering, renewing, or canceling the registration of a business name in Illinois. This guide will walk you through the process to fill out this form online, ensuring you provide all necessary information accurately.

Follow the steps to complete the IL LLC-45.20 form online.

- Click the ‘Get Form’ button to access the IL LLC-45.20 form and open it in the online editor.

- Indicate the purpose of the form by circling one of the options: 'Application for Registration of Name,' 'Renewal of Registered Name,' or 'Cancellation of Registered Name.'

- Enter the name of the Limited Liability Company in the provided field. Ensure that it matches the name registered in your home state.

- Specify the state or country where your organization is established. This information is crucial for verifying the legitimacy of your LLC.

- Fill in the date of organization. This should reflect the date when your LLC was officially formed.

- Provide a brief statement describing the nature of the business. This can include the services or products you offer and any relevant details about your operations.

- Enter the post office address for receiving notices from the Secretary of State. Ensure it is accurate and up-to-date.

- Confirm that your LLC is not currently transacting business in Illinois by checking the designated statement.

- Attach a Certificate of Good Standing or Existence, which must be dated within the last 30 days and authorized by the appropriate officer from your organizing state.

- Review all information for accuracy. Once confirmed, you may proceed to submit the form.

- After submission, you can save changes, download, print, or share the completed form as needed.

Complete your IL LLC-45.20 form online today and ensure your business name is properly registered or renewed.

To fill out an LLC tax return, you'll begin by gathering all relevant financial documents, such as income statements and expense reports. Then, use the appropriate IRS forms for reporting income, including Schedule C for single-member LLCs or Form 1065 for multi-member LLCs. Understanding your tax obligations is essential for compliance. Uslegalforms offers guidance on properly completing your LLC tax return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.