Loading

Get Il I 204 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL I 204 online

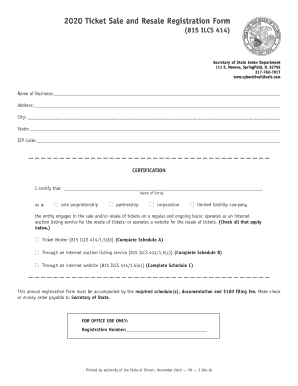

The IL I 204 form is essential for businesses involved in ticket sales and resales in Illinois. This guide provides a clear, step-by-step approach to completing the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the IL I 204 form online.

- Click the ‘Get Form’ button to obtain the IL I 204 form and open it in your preferred online editor.

- Fill in the name of your business in the designated field. Ensure that it matches the registered name of your entity.

- Complete the address section, including the street address, city, state, and ZIP code. Verify that all information is accurate.

- In the certification section, provide the name of the entity engaging in ticket sales or resales.

- Select the type of entity you are registering by checking the appropriate box for sole proprietorship, partnership, corporation, or limited liability company.

- Indicate all applicable methods in which your entity engages in ticket sales by checking the appropriate boxes. Complete any relevant schedules as required.

- Make sure to include the required documentation and the $100 filing fee with your submission.

- Once completed, save your changes. You can then download, print, or share the form as needed.

Complete your IL I 204 form online today to ensure compliance with ticket sales regulations.

In federal court, the party who requests the expert deposition typically bears the costs. These costs can include witness fees, travel expenses, and other related charges. Under IL I 204 guidelines, it's critical to account for these financial considerations in your case. To streamline the process, uslegalforms offers resources that can guide you through managing deposition expenses effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.