Loading

Get Il I 188.2 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL I 188.2 online

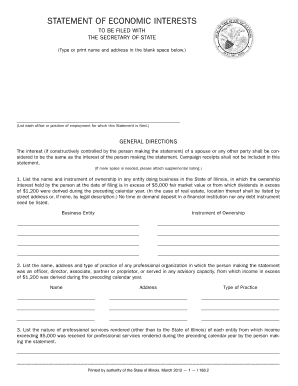

The IL I 188.2 form is an essential document for declaring economic interests in Illinois. This guide provides straightforward steps to assist users in accurately completing the form online.

Follow the steps to efficiently complete the IL I 188.2 online.

- Press the ‘Get Form’ button to access the IL I 188.2 form and open it in your preferred online editor.

- In the designated area, type or print your name and address clearly.

- List each office or position of employment for which this statement is filed, ensuring that the information is precise and up to date.

- For Section 1, provide the name and instrument of ownership of any entity in Illinois where your ownership interest exceeds $5,000 or from which dividends over $1,200 were received in the previous calendar year.

- In Section 2, enter the name, address, and type of practice of any professional organization where you were an officer, director, associate, partner, or proprietor, and from which income exceeding $1,200 was received during the last year.

- In Section 3, describe the nature of professional services rendered to any entity that yielded income exceeding $5,000 during the past calendar year.

- For Section 4, identify any capital asset that realized a capital gain of $5,000 or more in the previous calendar year, including the specific address or legal description.

- Section 5 requires you to list any compensated lobbyist with whom you maintain a close economic association, detailing the legislative matters and type of economic activity involved.

- In Section 6, specify any entity doing business in Illinois from which you received income over $1,200, including your position held.

- For Section 7, document the names of any units of government that employed you in the prior year, excluding those for which you are required to file this statement.

- Section 8 asks for the name of any entity from which you received gifts valued over $500 in the previous year.

- End with the verification section, where you must sign and date to declare that the statement is true and complete.

- Once you have completed the form, save your changes, and download or print the document as needed.

Complete your documents online today to ensure all necessary compliance and accuracy.

Yes, you can file your Illinois tax return online through the Illinois Department of Revenue's e-filing system. This user-friendly platform provides a streamlined process for filing your taxes accurately and efficiently. Always refer to the IL I 188.2 for detailed instructions on online submissions. For further assistance, uslegalforms offers resources that can guide you through the e-filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.