Loading

Get Il Bca 14.30 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL BCA 14.30 online

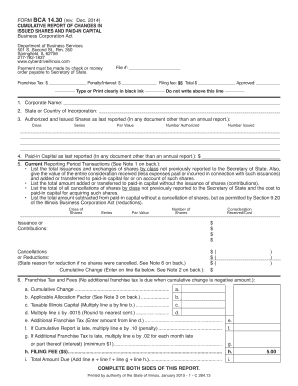

The IL BCA 14.30 form is crucial for reporting changes in issued shares and paid-in capital for business corporations in Illinois. This guide aims to provide step-by-step instructions for accurately completing the form online, ensuring compliance with the state's requirements.

Follow the steps to effectively complete the IL BCA 14.30 online.

- Click ‘Get Form’ button to retrieve the IL BCA 14.30 form and launch it in the online editor.

- Enter the corporate name in the designated field, ensuring that it matches the name registered with the Secretary of State.

- Indicate the state or country of incorporation in the corresponding section.

- Report the authorized and issued shares as last documented, filling in the class, series, par value, number authorized, and number issued for each type of share.

- Provide the paid-in capital as last reported, ensuring accuracy in the dollar amount presented.

- Outline the current reporting period transactions, detailing any issuances, exchanges, contributions, cancellations, or reductions of shares. Use the appropriate sections to accurately note these changes.

- Complete the franchise tax and fees section, calculating cumulative change, allocation factor, taxable Illinois capital, and additional franchise tax as necessary.

- Report transactions from previous reporting periods that were not previously filed, detailing any issuances, contributions, cancellations, or reductions.

- List the authorized and issued shares after any changes in the indicated fields.

- Enter the revised paid-in capital amount after changes.

- Sign and date the form in the designated area, ensuring that the signature is from a duly authorized officer of the corporation.

- Review all uploaded information for accuracy, and upon completion, save the changes, download the document, print it for record-keeping, or share it as required.

Complete your documents online now to ensure compliance and timely submission.

Related links form

Yes, if you are closing your business, you need to file articles of dissolution according to IL BCA 14.30. This formal process prevents future liabilities or complications for your business. It is essential to complete this step to ensure all legal obligations are fulfilled.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.