Loading

Get Ga Att-6 Instructions 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA ATT-6 Instructions online

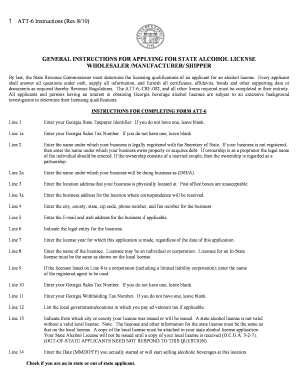

The GA ATT-6 Instructions provide a clear and structured guide for applicants seeking a state alcohol license in Georgia. This guide will help you complete the form accurately and efficiently, ensuring you fulfill all legal requirements.

Follow the steps to successfully complete your GA ATT-6 application.

- Press the ‘Get Form’ button to access the GA ATT-6 Instructions form and open it in your preferred editing tool.

- Enter your Georgia State Taxpayer Identifier in Line 1. If you do not possess one, leave this field blank.

- For Line 1a, input your Georgia Sales Tax Number if available; otherwise, leave it empty.

- On Line 2, provide the legal name of your business as registered with the Secretary of State. If unregistered, input the name under which your business operates or holds property.

- Fill in Line 2a with the name your business will operate under (D/B/A).

- Line 3 requires you to enter the physical business location address. Note that post office boxes are not permitted.

- In Line 3a, include the business address for correspondence purposes.

- Provide city, county, state, zip code, phone number, and fax number in Line 4.

- Line 5 is where you can enter the email and website address for your business, if applicable.

- Indicate the legal entity of your business in Line 6.

- Input the license year your application pertains to in Line 7, regardless of the submission date.

- In Line 8, enter the name of the licensee, which can be an individual or a corporation.

- If the licensee from Line 8 is a corporation, as indicated in Line 9, enter the name of the registered agent.

- Provide your Georgia Sales Tax Number again in Line 10, leaving it blank if you do not have one.

- Input your Georgia Withholding Tax Number in Line 11, if applicable.

- List local governments or counties where you pay ad valorem tax in Line 12, if it applies.

- Indicate the county or city from which your local license was or will be issued in Line 13, noting that a local license copy is required.

- Enter the start date for selling alcoholic beverages in Line 14 and confirm if you are an in-state or out-of-state applicant.

- Decide on the type of license that applies to your business in Line 15 after determining the distance to the nearest school or church, if necessary.

- Carefully review the regulations in Line 16 before responding.

- Ensure the application is signed correctly according to the instructions, and prepare for payment and submission of required bonds and personnel statements.

- Finally, save your changes, and download or print your completed form for your records.

Complete your GA ATT-6 form online today to initiate the process for your state alcohol license.

Related links form

The filing requirements for Georgia depend on your income level, filing status, and residency. Generally, if you earn income in Georgia, you must file a tax return. Refer to the GA ATT-6 Instructions for specific thresholds and exceptions that may apply to your situation. For comprehensive support and form access, uslegalforms offers valuable resources tailored to Georgia residents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.