Get Apply For Irs Check Cashing License Form 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Apply For Irs Check Cashing License Form online

Filling out the Apply For Irs Check Cashing License Form online can seem daunting, but with clear guidance, you can complete the process efficiently. This guide will walk you through each section of the form, ensuring you understand what is required.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

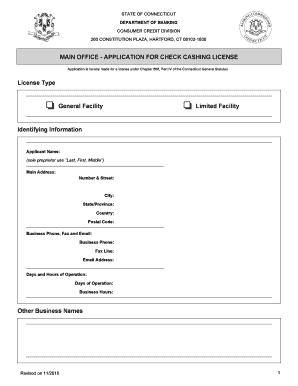

- In the section labeled 'License Type,' choose between 'General Facility' or 'Limited Facility' as applicable.

- Fill in the 'Identifying Information' section, starting with your name. If you are a sole proprietor, use the format 'Last, First, Middle.' Then, provide your main address details, including number and street, city, state or province, country, and postal code.

- Input your business's contact information, including business phone, fax, and email address. Follow this with the days and hours of operation.

- List any other business names under which you operate, if applicable.

- Complete the 'Contact Employee Information' section by providing the first and last name of the designated employee, their company, and the mailing address where they can be reached.

- Include 'Consumer Complaint Employee Information' with similar details including name, title, and address.

- In the 'Books and Records Information' section, provide necessary details such as the name, title, and contact information of the individual responsible for records.

- Answer the questions regarding 'Other Activities' truthfully, indicating if the applicant will engage in any non-check cashing activities or share space with other financial services.

- Fill in the 'Legal Status' section by providing your form of organization, state of formation, date of formation, and identification numbers as required.

- Respond to the 'Disclosure Questions' thoroughly, indicating any necessary details about criminal, regulatory, or civil disclosures as they pertain to the applicant or any controlling individuals.

- Complete the 'Control Persons' section, listing direct and indirect owners with relevant information, including names, addresses, and percentage of ownership.

- Finally, in the 'Signature of Applicant' section, sign and print your name and title. Ensure that the signature belongs to a control person listed earlier in the application.

- After completing the form, save changes, download, print, or share the form as necessary.

Complete your application online today and secure your check cashing license!

To start a check cashing business in Georgia, you need to first apply for the required licenses and permits. It is essential to complete the Apply For Irs Check Cashing License Form accurately, ensuring that all necessary information is included. Once you have gathered the required documentation and submitted your application, you will need to comply with state regulations regarding fees and operational guidelines. Utilizing platforms like uslegalforms can simplify this process by providing the relevant forms and guidance needed to get started smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.