Loading

Get Va Vec Fc-21 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA VEC FC-21 online

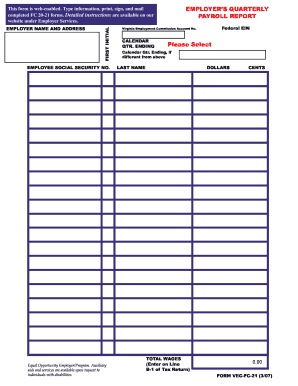

Filling out the VA VEC FC-21 form online is essential for employers to report their quarterly payroll. This guide will provide you with step-by-step instructions to ensure accurate submission of your payroll report, making the process seamless for all users.

Follow the steps to accurately complete your VA VEC FC-21 form online:

- Press the ‘Get Form’ button to access the VA VEC FC-21 form and open it in the online editor.

- In the 'Employer Name and Address' section, enter the official name and address of the employer.

- Fill in the 'Employee Social Security No.' section for each employee that worked during the reporting quarter.

- Input the 'Federal EIN' which is your Employer Identification Number for federal tax purposes.

- Indicate the 'Virginia Employment Commission Account No.' to properly identify your account.

- Select the 'Calendar Qtr. Ending' from the dropdown menu that represents the end of the reporting quarter.

- Complete the 'Last Name' field for the primary contact or executive responsible for payroll.

- Report the total dollar amount of wages paid in the 'Total Wages' section, to be entered on Line B-1 of the tax return.

- Enter the taxable wage amounts in the subsequent sections according to the number of employees and wages reported.

- Sign and date the form in the 'Certification' section to confirm the information is accurate and truthful.

- Once all fields are completed, save your changes, download the completed form, and print it for submission.

Ensure your payroll reporting is timely and accurate by completing the VA VEC FC-21 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Virginia, whether you can collect unemployment after being fired primarily depends on the reason for your separation. If you were terminated for misconduct, you might not qualify for benefits, as clarified in the VA VEC FC-21 guidelines. Understanding these regulations can help you assess your situation more accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.