Loading

Get Oh Opers A-4t 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH OPERS A-4T online

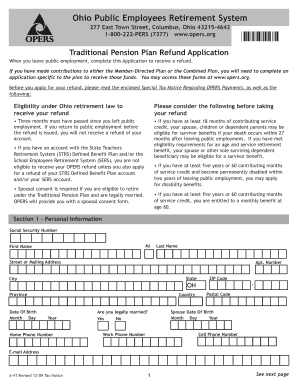

Filling out the Ohio Public Employees Retirement System A-4T form is an important step for individuals seeking a refund after leaving public employment. This guide provides clear instructions to help you complete this form online efficiently and accurately.

Follow the steps to successfully complete your refund application.

- Press the ‘Get Form’ button to access the A-4T form and open it in the online editor.

- Begin by filling out Section 1, which asks for your personal information. Provide your Social Security number, first and last name, mailing address, and contact details, including phone numbers and email address.

- In Section 2, if you wish to roll over your refund to an IRA or eligible retirement plan, confirm that your plan administrator accepts rollovers and fill in the details of the trustee you are rolling over to.

- In Section 3, indicate any additional federal tax withholding amount you want deducted from your refund, in addition to the mandatory withholding.

- Proceed to Section 4, where you need to indicate your membership in other retirement systems. Check the appropriate boxes for any retirement plans you belong to.

- Complete Section 5 if you were a qualified public safety employee, marking the appropriate box if applicable.

- If you left public employment less than a year ago, Section 6 must be completed by your former employer's payroll officer to verify your employment status.

- In Section 7, acknowledge your application by signing the form in the presence of a Notary Public or your former employer’s payroll officer. Ensure that appropriate notary information is provided.

- After filling out all required sections, review your completed form for accuracy and completeness.

- Once verified, save your changes, and proceed to download, print, or share the form as needed.

Complete your form online today to ensure a smooth refund process.

The Employee Pension System (EPS) generally operates on a pre-tax basis, similar to OPERS. This means your contributions reduce your taxable income during your working years. However, just like OPERS, the withdrawals during retirement will be taxed as income. Understanding these tax implications can help you manage your financial planning more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.