Loading

Get Ny Si-6 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY SI-6 online

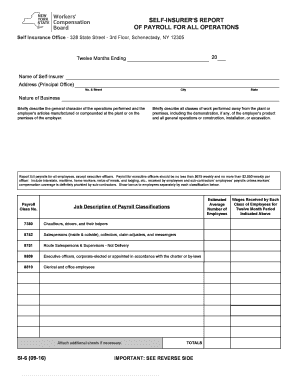

The NY SI-6 form is essential for self-insurers to report payroll information for all operations. This guide will provide clear instructions on how to fill out the form effectively online, ensuring accuracy and compliance.

Follow the steps to fill out the NY SI-6 form online with ease.

- Press the ‘Get Form’ button to access and open the NY SI-6 form in the editor.

- Begin by entering the name of the self-insurer in the designated field.

- Fill in the address of the principal office, including the street number, city, and state.

- In the 'Nature of Business' section, provide a brief description of the general character of operations and any products manufactured.

- Describe all classes of work performed away from the main premises, including any demonstrations or operations undertaken.

- Report full payrolls for all employees, excluding executive officers. Note that payroll for executive officers should be no less than $675 weekly and no more than $2,050 weekly per officer.

- In the Payroll section, input the class numbers along with the estimated average number of employees and their corresponding job descriptions.

- Attach additional sheets if necessary to provide all classifications and payroll data.

- List the location of all factories and offices in New York State, along with the number of employees at each location.

- Affirm the accuracy of the provided information by filling in your title and the company name where indicated.

- Sign and date the form, including your telephone number and printing or typing your name for clarity.

- Once completed, save changes to the form; you can then download, print, or share the form as needed.

Complete your NY SI-6 form online today to ensure your self-insured operations are accurately reported.

The NY ST-120 form is a sales tax exemption certificate used primarily by organizations that qualify for tax-exempt status. This form allows businesses to make purchases without paying sales tax, provided they meet specific criteria. For companies engaging in transactions involving NY SI-6, accurately using the NY ST-120 is essential for maintaining compliance and maximizing savings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.