Loading

Get Ny Is-4 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IS-4 online

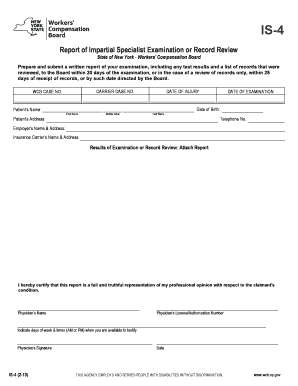

Navigating forms can be challenging, particularly when accuracy is crucial. This guide provides a step-by-step approach to completing the NY IS-4 form, offering clear direction to ensure your submission is thorough and timely.

Follow the steps to successfully complete the NY IS-4 form.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Begin by entering the carrier case number and WCB case number at the top of the form. Ensure the information is accurate to avoid processing delays.

- Fill in the patient's personal details. This includes the patient's first name, middle initial, last name, date of birth, address, and telephone number.

- Indicate the date of injury clearly, followed by the date of examination. Accurate dates will facilitate smoother case handling.

- Record the employer's name and address, ensuring that this matches the information documented in the case file.

- Provide the insurance carrier's name and address, as this information is vital for processing the report.

- Summarize the results of the examination or record review in the designated area. Ensure to attach any relevant reports that support your findings.

- Certify the report by entering your name and license number. This certification indicates that the report is a truthful representation of your professional opinion.

- Specify your availability for testimony by indicating the days of the week and times (AM or PM) that you can be reached.

- Sign the document and include the date of signing. This step concludes your report.

- Once completed, save changes to the document. You can opt to download, print, or share the form as needed.

Complete your documents online today for an efficient filing experience.

NYC 4S is often used interchangeably with form NYC 4S and refers to the documentation needed for accurate tax reporting in New York. This form is essential for losing deductions and ensuring compliance with city tax regulations. Utilizing the NYC 4S properly helps individuals avoid costly mistakes in their tax filings. Resources available on the USLegalForms platform simplify this process for users.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.