Loading

Get Ny Form R 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY Form R online

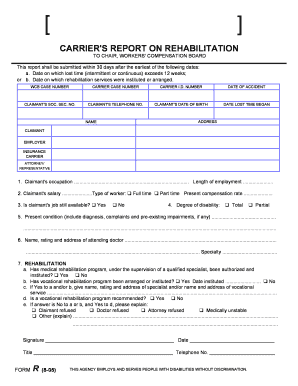

Filling out the NY Form R online can streamline your reporting process to the Workers' Compensation Board. This guide will walk you through each step, ensuring that you understand the necessary components of the form.

Follow the steps to complete your form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital document editor.

- Enter the WCB case number and carrier case number accurately. These identifiers are essential for processing your report.

- Fill in the carrier I.D. number and the date of the accident. Ensure that all dates are formatted correctly.

- Provide the claimant's social security number and telephone number. This personal information is necessary for communication purposes.

- Input the claimant's date of birth and the date lost time began. Double-check these entries for accuracy.

- Complete the address section, ensuring it reflects the claimant's current residence.

- For the claimant's occupation, indicate their job title and the length of employment. This detail is important for understanding the claimant's work history.

- Document the claimant's salary and select the type of worker—check either the 'Full time' or 'Part time' option as appropriate.

- Fill in the present compensation rate, which should correspond with the information provided earlier.

- Answer whether the claimant's job is still available by selecting 'Yes' or 'No.'

- Indicate the degree of disability by selecting either 'Total' or 'Partial.'

- Provide details for the present condition, including diagnosis and any pre-existing impairments.

- Specify the attending doctor's name, rating, and address. Include their specialty for reference.

- For the rehabilitation section, indicate if a medical rehabilitation program has been authorized and instituted by checking 'Yes' or 'No.'

- Continue to specify if a vocational rehabilitation program has been arranged. Include the date it was instituted if applicable.

- If applicable, provide the name and address of the vocational specialist or service.

- Indicate whether a vocational rehabilitation program is recommended with a 'Yes' or 'No' selection.

- If Rehabilitation options are not pursued, explain the reasons provided in the respective fields.

- Finally, sign the form, and include the date and your title along with the telephone number for further reference.

Complete your NY Form R online today to ensure efficient filing and processing.

The New York City R local tax applies primarily to certain residents and individuals who work in New York City. This tax is calculated based on your taxable income and is reported on your tax return. If necessary, your filing with NY Form R can help ensure you meet all local tax regulations and minimize your tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.