Loading

Get Ny C-251 2001-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY C-251 online

Filling out the NY C-251 form online is a crucial step in requesting reimbursement for compensation payments. This guide will provide you with clear instructions to ensure that your application is completed accurately and efficiently.

Follow the steps to complete the NY C-251 form online

- Click 'Get Form' button to obtain the NY C-251 and open it for editing.

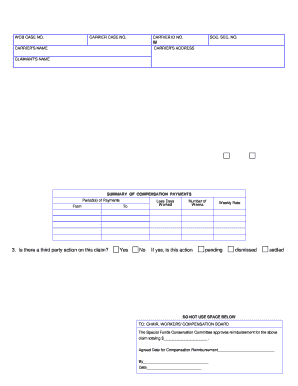

- Fill in the WCB case number, carrier case number, and carrier ID number in the designated fields. This information is essential for the correct identification of your claim.

- Enter the carrier's name and address. Make sure this information is accurate as it reflects the organization submitting the claim.

- Complete the claimant's name accurately, as it pertains to the individual receiving benefits. Accuracy is crucial for proper processing.

- In Section A, provide details of the reimbursement you are requesting. Indicate the number of weeks, the date range, and the amounts owed for each period. This section should summarize the specific compensation payments made.

- For any lump sum payments, complete Section B, ensuring to specify how many weeks this lump sum covers and the rate per week.

- If applicable, fill out Section C for funeral expenses incurred, stating the amount clearly.

- Complete Section D for any other reimbursement requests, specifying the nature of the expenses.

- Calculate the total claim for reimbursement at the bottom of the form. Double-check your calculations for accuracy.

- Indicate whether this claim represents an initial request for reimbursement by selecting 'Yes' or 'No' in the provided field.

- Add the date when the claimant's status was last checked in the designated field to keep your records up to date.

- Complete the summary of compensation payments, including all payments related to the period for which reimbursement is requested.

- If there is a third-party action, specify its status and any relevant information regarding its outcome.

- Sign the statement certifying that the information provided is true and correct. Enter your title and telephone number below the signature.

- Finally, review the information for accuracy, then save your changes and download, print, or share the completed form as needed.

Begin the process of completing your documents online today.

Related links form

To qualify for the NYC school tax credit, applicants usually must be homeowners who meet specific income and residency requirements. Additionally, you must have children attending eligible schools in the city. It's essential to stay updated on any changes to the program eligibility criteria.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.