Loading

Get Ny A-9 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY A-9 online

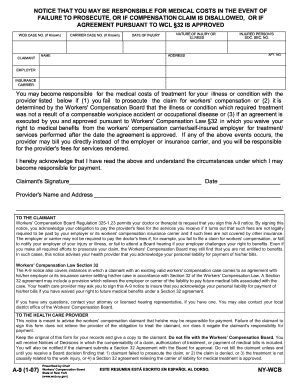

The NY A-9 form is an important document that informs users of their potential responsibility for medical costs related to their workers' compensation claims. This guide provides clear instructions for completing the NY A-9 online, ensuring that users can fulfill their obligations efficiently.

Follow the steps to complete the NY A-9 form online.

- Press the ‘Get Form’ button to access the NY A-9 form and open it for editing.

- Enter the WCB case number if known. This identifier helps in linking your form to your existing claim and its associated records.

- Fill in the claimants' information, including their full name, date of injury, and nature of the injury or illness. Accurate details are essential for processing your claim.

- Provide the claimant's address and social security number. Ensure that all information is complete to avoid any delays in processing.

- List the employer's name and the insurance carrier. This information is crucial for determining who will be liable for medical costs.

- Carefully read the acknowledgment statement regarding understanding the responsibility for medical costs. This ensures that you are aware of the scenarios that can lead to personal liability.

- Sign and date the form to confirm your understanding and acceptance of the terms. Your signature solidifies your acknowledgment of potential medical costs.

- Once all fields are completed and reviewed, you can save your changes, download, print, or share the completed form as needed.

Complete your documents online for a smoother experience.

Calculating your adjusted gross income involves summing all sources of income and then subtracting allowable deductions. These deductions may include retirement plan contributions or health savings account contributions. Understanding how to accurately calculate your AGI is crucial when preparing for your NY A-9 tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.