Get Mo Modes-4633 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MODES-4633 online

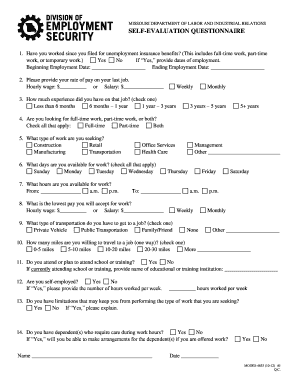

Filling out the MO MODES-4633 online is an essential step for individuals seeking unemployment benefits in Missouri. This guide will provide you with clear and supportive instructions on how to navigate the form's various sections effectively.

Follow the steps to complete the MO MODES-4633 form successfully.

- Press the ‘Get Form’ button to obtain the document and access it in your editor.

- Answer whether you have worked since filing for unemployment insurance benefits by selecting 'Yes' or 'No'. If 'Yes', provide the beginning and ending employment dates.

- Provide your rate of pay from your last job by indicating your hourly wage or salary.

- Indicate how much experience you had on that job by checking the appropriate box.

- Select your job preferences by checking all that apply: full-time, part-time, or both.

- Specify the type of work you are seeking by selecting from the given options.

- Indicate the days you are available for work by checking the relevant boxes.

- Input your available work hours, specifying both the start and end times.

- State the lowest pay you will accept for work by providing your expected hourly wage or salary.

- Choose your mode of transportation for commuting to work by selecting one of the provided options.

- Provide the distance you are willing to travel to a job by selecting one of the options.

- Indicate if you attend or plan to attend school or training; if currently attending, provide the name of the institution.

- Specify if you are self-employed and provide the number of hours you work per week.

- Note any limitations that may impact your ability to perform the type of work you are seeking.

- Indicate if you have dependents who require care during work hours and specify if you can make arrangements if offered a job.

- After completing all sections, save any changes made, download a copy, print, or share the form as needed.

Complete your MO MODES-4633 form online today to ensure your unemployment benefits process is smooth and efficient.

Get form

Related links form

As of now, Massachusetts pays the highest maximum unemployment benefits in the United States, which can exceed $1,000 weekly. However, benefit amounts and eligibility criteria can differ widely between states, including Missouri. Stay informed about various state programs through resources like MO MODES-4633, where you can explore options tailored to your needs. This knowledge empowers you to make informed decisions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.