Loading

Get Il Per D 199.4 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL Per D 199.4 online

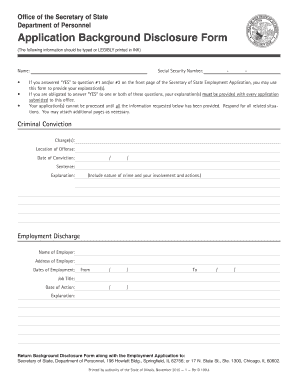

The IL Per D 199.4 form is a crucial document used for background disclosure in employment applications. This guide will help you navigate through the online process of filling out the form, ensuring all necessary information is included accurately.

Follow the steps to complete the IL Per D 199.4 online.

- Click the ‘Get Form’ button to access the IL Per D 199.4 form and open it in your preferred online platform.

- Enter your name in the designated field. Make sure to type it clearly, as it is essential for identifying your application.

- Provide your social security number by entering it in the appropriate section. Remember to format it as XXX-XX-XXXX.

- If you answered 'YES' to questions #1 and/or #2 on the Secretary of State Employment Application, briefly explain your situation in the provided fields. It's important to include all necessary details.

- For criminal convictions, fill in the charge(s), location of the offense, date of conviction, and clearly outline your sentence and explanation, detailing the nature of the crime and your involvement.

- In the employment discharge section, enter the name and address of the employer, your job title, and the dates of employment. Make sure to provide a clear explanation of the discharge.

- Review all the entered information for accuracy. It is crucial that all fields are filled out completely to avoid delays in processing your application.

- After ensuring all information is accurate, save the completed form. You may have the option to download or print it as needed.

- Submit the completed IL Per D 199.4 form along with your Employment Application to the designated Secretary of State address.

Begin filling out your IL Per D 199.4 form online to ensure a smooth application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out the Illinois withholding allowance, you need to complete Form IL-W4 accurately. Start by writing your basic details, then follow the calculation process as illustrated by the form to determine your allowances. Always remember to consult IL Per D 199.4 to ensure you're making the right choices for your tax withholdings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.