Get Ct Worksheet To Help Determine Exempt/non-exempt Status Of Managerial Or Executive Employees

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT worksheet to help determine exempt/non-exempt status of managerial or executive employees online

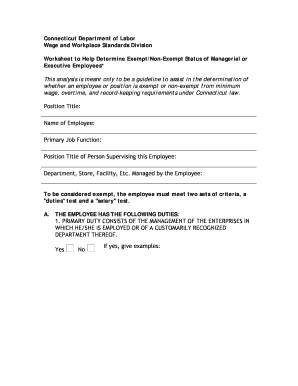

This guide provides clear and comprehensive instructions for filling out the CT Worksheet designed to help determine whether an employee qualifies as exempt or non-exempt under Connecticut law. Whether you are a manager or human resources professional, you will find valuable information to assist you in this process.

Follow the steps to complete the CT worksheet effectively.

- Press the 'Get Form' button to access the CT Worksheet and open it in your preferred online editor.

- Start by entering the position title, name of the employee, and their primary job function in the designated fields.

- Provide the position title of the person supervising the employee, along with the department, store, or facility managed by the employee.

- Begin answering the exempt duties questions in Section A. Respond with 'Yes' or 'No' based on the employee's actual duties and provide examples where necessary.

- In Section B, list the exempt duties along with the weekly hours spent on each to calculate total weekly hours spent at exempt duties.

- Proceed to Section C, where you will identify non-exempt duties and record the weekly hours spent on each.

- Complete Section D by summarizing the total weekly hours worked and exempt hours, including the percentage of exempt hours.

- Move to Section E and answer the salary test questions regarding the employee's salary to confirm compliance with the salary requirements.

- In Section F, interpret the results based on your answers and determine if the employee may be considered exempt.

- Once all sections are accurately completed, save your changes, download, print, or share the form as required.

Start completing the CT worksheet online today to ensure proper classification of employees.

The IRS identifies three primary exemptions for classifying employees as exempt: executive, administrative, and professional. Each category has distinct criteria related to job duties, responsibilities, and payment structure. To effectively assess these exemptions, the CT Worksheet to Help Determine Exempt/Non-Exempt Status of Managerial or Executive Employees provides a systematic approach. This tool assists employers in accurately determining an employee's status based on their job role.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.