Get Ct Wca-1s 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT WCA-1S online

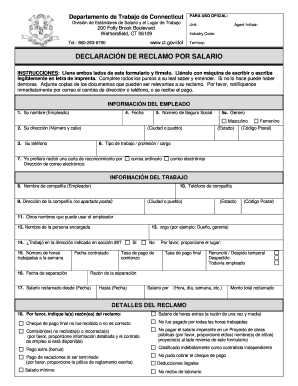

The CT WCA-1S form is a crucial document for individuals seeking to claim unpaid wages or address improper payment issues in Connecticut. This guide provides comprehensive, step-by-step instructions to help users fill out this form accurately and effectively.

Follow the steps to successfully complete your CT WCA-1S online.

- Press the ‘Get Form’ button to access the CT WCA-1S form and open it for editing.

- In the first section, enter your personal information including: your name, address, phone number, and date. Ensure that this information is accurate and clear.

- Provide your social security number and indicate your gender by selecting either 'Male' or 'Female'.

- Detail your employment information in the next section. Begin with the name of your employer, their address, and contact details.

- Indicate how many hours you worked per week and provide your start date, separation date, and reason for leaving the job.

- Fill in the salary information, including the amount you believe you are owed, detailing the time period for which you are claiming unpaid wages.

- In the claims section, check all applicable reasons for your wage claim, and provide an explanation of why you believe the employer owes you these wages.

- If applicable, indicate whether you have requested the last payment from your employer, including the name and job title of the person you spoke with.

- Review all information for completeness and clarity. Ensure that all questions are answered and that you have signed the form.

- Save your changes to the form. Depending on your needs, you can then either download, print, or share the completed CT WCA-1S form.

Begin the process of filing your wage claim by completing the CT WCA-1S online today.

To file for workers' comp in CT, start by reporting your injury to your employer promptly. You will then need to fill out the appropriate forms, including the DWC 1, and submit them to your employer or their insurance carrier. Keeping copies of all documents is crucial for your records. US Legal Forms offers a range of resources to assist you in this process, ensuring you have all the necessary information to navigate your claim successfully.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.