Loading

Get Ct Wca-1 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT WCA-1 online

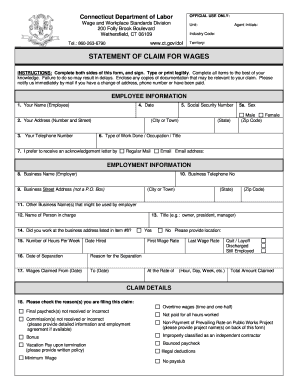

Filling out the CT WCA-1 form is an important step for individuals seeking to claim unpaid wages in Connecticut. This guide provides a clear and structured approach to completing the form online, ensuring that you provide all necessary information accurately.

Follow the steps to complete the CT WCA-1 online

- Click ‘Get Form’ button to obtain the CT WCA-1 form and open it in the editor.

- Begin by providing your personal information in the 'Employee Information' section. This includes your name, address, telephone number, and Social Security number. Ensure that all entries are legible and accurate.

- Indicate your sex and type of work done or occupation by filling in the appropriate fields. Select your preferred method of receiving an acknowledgment letter.

- In the 'Employment Information' section, enter the name and address of your employer, including their telephone number. If applicable, provide any other business names associated with your employer.

- Specify the name and title of the person in charge at your workplace, and confirm whether you worked at the listed business address. Include your hiring date and the number of hours you worked per week.

- Fill out the details regarding your employment termination. Include your last wage rate, the separation date, and the reason for your separation.

- Provide specifics about the wages claimed, including the start and end dates for which you are claiming wages, along with the total amount due.

- In the 'Claim Details' section, check all applicable reasons for filing your claim and explain why you believe the employer owes you wages. You can include dates and hours worked, and attach extra sheets if necessary.

- Answer the question regarding whether you requested the owed wages from your employer, including the name and title of the person you spoke with. If not, explain why.

- Review your completed form for accuracy and legibility. Ensure all required fields are filled to avoid delays.

- Sign the form to attest that your statement is true, and if you are under 18 years old, ensure a parent or guardian signs as well.

- Upon completion, you can save changes, download, print, or share the form as needed.

Complete your CT WCA-1 form online today to ensure your claim for wages is processed efficiently.

The CT standard deduction is a specific amount that reduces taxable income for individuals and families in Connecticut. For the tax year, this deduction varies based on filing status, helping to lower the overall tax burden. Taking advantage of the CT standard deduction can be beneficial, especially when filing your CT WCA-1 form to ensure all deductions are documented properly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.