Get Ct Uc-1 Np 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT UC-1 NP online

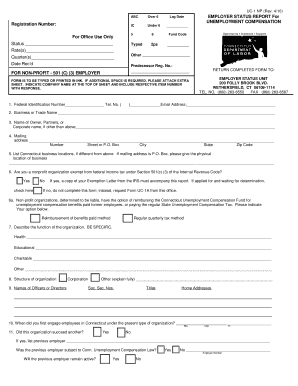

The CT UC-1 NP form is essential for non-profit organizations seeking to report their unemployment compensation status. This guide provides a clear, step-by-step approach to successfully completing this form online, ensuring you meet all necessary requirements.

Follow the steps to correctly complete the CT UC-1 NP online.

- Press the ‘Get Form’ button to obtain the CT UC-1 NP form and open it for completion.

- Begin by entering your Federal Identification Number in the designated field. Make sure to include your telephone number and email address as well.

- Next, provide your business or trade name in the specified section. Ensure that this accurately represents your organization.

- Fill in the name of the owner, partners, or the corporate name if applicable.

- Input your mailing address, including the street or P.O. Box, city, state, and zip code.

- If your mailing address is a P.O. Box, please list any physical business locations that differ.

- Indicate whether your organization is exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code. If yes, a copy of your Exemption Letter from the IRS must be attached.

- Choose your payment option regarding unemployment compensation benefits: indicate if you prefer to reimburse benefits paid or opt for the regular quarterly tax method.

- Describe the function of your organization in detail, specifying if it is health-related, educational, charitable, or other.

- Select the structure of your organization from the provided options, such as Corporation or Other, and provide necessary details.

- List the names, social security numbers, titles, and home addresses of officers or directors of the organization.

- Provide the date when you first engaged employees in Connecticut under your current organizational structure.

- If applicable, state whether your organization succeeded another, and provide the previous employer's name and details regarding Connecticut Unemployment Compensation Law.

- Indicate if you were a Connecticut employer in any part of any 13 weeks in the preceding three calendar years and provide those years.

- Confirm if you will be a Connecticut employer in any part of 13 weeks within the current or next calendar year and specify the year.

- Record the number of individuals employed in Connecticut in specific weeks, including part-time employees and paid corporate officers, as well as total wages paid each quarter.

- At the end of the form, certify that the information is true and correct by signing and providing the printed name and title.

- Finally, save changes, download, print, or share the completed form as required.

Encourage completing your CT UC-1 NP form online for a smooth submission process.

The PA UC-2 report is a document used for reporting unemployment compensation claims in Pennsylvania. While not directly related to CT UC-1 NP, it is crucial for businesses operating in multiple states to be aware of different reporting requirements. This report helps track unemployment claims and ensures compliance with state regulations. If you deal with multiple states, platforms such as USLegalForms can streamline the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.