Loading

Get Ct Minimum Wage Rates For Service Employees

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT Minimum Wage Rates for Service Employees online

Understanding the Connecticut Minimum Wage Rates for Service Employees is essential for ensuring compliance with state regulations. This guide provides a detailed walkthrough of how to accurately fill out the form online, assisting users in navigating the necessary sections and fields.

Follow the steps to complete the CT Minimum Wage Rates form

- Click 'Get Form' button to access the document and open it in the appropriate editor.

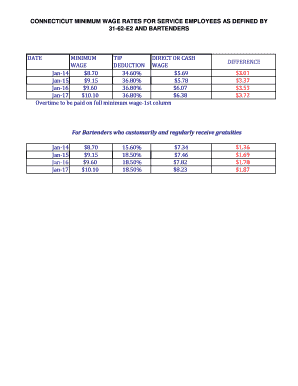

- Review the date and minimum wage sections. Ensure that you are referencing the correct time period for which you are filling out the form. Make note of the minimum wage and percentage tip deductions applicable for each year.

- Fill in the direct or cash wage section. This should reflect the minimum wage in effect for the relevant period, along with any applicable tip deductions that the user may receive.

- For bartenders, confirm the gratuity section. Input the correct minimum wage designated for bartenders who typically receive tips, and ensure the percentage and cash wage are accurately filled in.

- Complete the overtime section, if applicable. Calculate and ensure that the correct minimum wage is indicated here, based on full minimum wage regulations.

- Review all entries for accuracy. Double-check that all figures and fields are properly filled out to avoid any mistakes or miscalculations.

- Once completed, save your changes. You may also choose to download, print, or share the document as needed to maintain your records.

Start completing the CT Minimum Wage Rates for Service Employees form online today!

In Connecticut, the 4-hour rule dictates that if an employee works more than four hours, they are entitled to a 30-minute meal break. Employers must adhere to this rule to promote worker well-being. Knowing such regulations is essential for understanding how they relate to CT Minimum Wage Rates for Service Employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.