Loading

Get Ca Edd De 3bhw 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA EDD DE 3BHW online

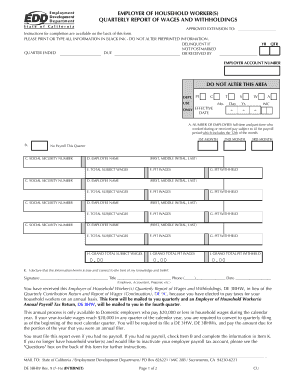

The CA EDD DE 3BHW form is designed for employers of household workers to report wages and withholdings. This user-friendly guide will walk you through the steps necessary to complete this form efficiently online, ensuring that you provide accurate information conforming to state requirements.

Follow the steps to complete the CA EDD DE 3BHW online:

- Click ‘Get Form’ button to obtain the form and open it in the editor. You will access the necessary fields and sections to fill out the report.

- In Item A, enter the total number of employees (full-time and part-time) who worked during the quarter. Provide a count for each of the three months included in the report.

- If you had no payroll for this quarter, check the box in Item B, and enter '0' in each of the three boxes in Item A, along with the Grand Total boxes in Items H, I, and J.

- Proceed to Item C, and enter the Social Security Number (SSN) for each employee. If an employee does not have an SSN, report their name and wages without it and take steps to secure one.

- In Item D, fill in the full names of each employee (first name, middle initial if applicable, and last name) as required.

- For Item E, enter the total subject wages paid to each employee during the quarter.

- In Item F, enter the amount of wages that are subject to California Personal Income Tax (PIT) for each employee.

- In Item G, record the total amount of PIT withheld from each employee's wages.

- Sum up all subject wages in Item H, PIT wages in Item I, and PIT withheld in Item J accordingly.

- Finally, in Item K, sign the form, state your title, provide your phone number, and date the completion of the form.

- Once all data is accurately entered, save any changes, download a copy for your records, and print or share the completed form as necessary.

Complete and submit your forms online to ensure compliance and timely reporting.

The DE4 form is filled out by employees to determine their withholding allowances for state income tax. It is crucial for letting your employer know how much tax to withhold from your paycheck. Accurate completion of this form can prevent issues during tax season, especially when combined with your CA EDD DE 3BHW submissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.