Get Ca Dlse-155 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DLSE-155 online

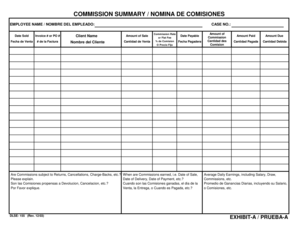

The CA DLSE-155 form is essential for documenting commission information related to employment. This guide will provide you with step-by-step instructions for filling out the form online, ensuring you accurately capture all necessary details.

Follow the steps to complete the CA DLSE-155 form online.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the employee's name in the designated field labeled 'Employee name'.

- Input the 'Date Sold' in the appropriate section, ensuring the format is clear and concise.

- Provide the invoice number or purchase order (PO) number in the field labeled 'Invoice # or PO #'.

- Fill in the 'Client Name' section with the name of the client involved in the transaction.

- Indicate whether commissions are subject to returns, cancellations, or charge-backs, and provide a brief explanation in the designated box.

- Record the case number in the section marked 'Case No.' to ensure proper tracking of the commission.

- Input the 'Amount of Sale' to detail the total sales figure.

- Specify the commission rate or flat fee in the 'Commission Rate or Flat Fee' field, denoted as a percentage or fixed amount.

- Fill out the 'Date Payable' section with the date when the commissions are expected to be paid.

- Explain when commissions are earned in the respective field, choosing from options such as 'Date of Sale', 'Date of Delivery', or 'Date of Payment'.

- Enter the 'Amount of Commission' to provide a clear value for what is due.

- Record the amount that has been paid in the 'Amount Paid' section.

- Input the 'Amount Due' to indicate how much is still required.

- Complete the final section by entering the 'Average Daily Earnings', which includes salary, draws, and commissions.

- Once all fields are filled, review the information for accuracy, then save your changes. You can also choose to download, print, or share the completed form as needed.

Complete your CA DLSE-155 form online today to ensure compliance and accurate record-keeping.

To report wage theft in California, you should complete and submit the CA DLSE-155 form to the Division of Labor Standards Enforcement. This form allows you to detail the circumstances of the wage theft, including the nature of your employment and the wages you believe are owed. Once submitted, the DLSE will investigate your claim and determine the next steps. Utilizing USLegalForms can streamline your reporting process, ensuring you provide all required information accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.