Get Ak Minimum Wage Exemption 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Minimum Wage Exemption online

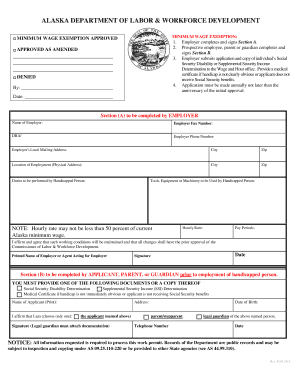

The AK Minimum Wage Exemption form allows employers to apply for permission to pay a wage lower than the minimum wage for specific individuals. This guide provides clear instructions on completing the form online to ensure compliance with state regulations.

Follow the steps to complete the AK Minimum Wage Exemption form online.

- Click the ‘Get Form’ button to obtain the AK Minimum Wage Exemption document and open it for editing.

- In Section A, the employer must complete their details. Fill in the name of the employer, fax number, phone number, local mailing address, and the physical address of the employment location. Ensure that all information is accurate.

- Next, provide the duties to be performed by the person with a handicap and list any tools, equipment, or machinery that will be used. This information helps establish the role and responsibilities associated with the position.

- Include the hourly rate, which must not be less than 50 percent of the current Alaska minimum wage. Specify the pay periods and ensure all information complies with state requirements.

- The employer must affirm that they will maintain appropriate working conditions and sign the form in the designated area, along with the printed name and date.

- In Section B, the applicant, parent, or guardian must complete their details. This section requires the applicant's name, address, date of birth, and telephone number.

- The applicant must select their relationship to the individual and provide a signature. If applicable, legal guardians must attach documentation to verify their relationship.

- Finally, ensure that all required documentation, such as the Social Security Disability Determination or a medical certificate, is attached. Once completed, save changes and proceed to download, print, or share the form as needed.

Complete your AK Minimum Wage Exemption application online today for a smoother process.

Related links form

Being exempt from minimum wage means that certain employees are not entitled to the standard minimum wage protections. This typically applies based on specific job functions, salary thresholds, and regulations outlined in the AK Minimum Wage Exemption. Understanding this concept is vital for both employees and employers to ensure compliance with labor laws. If you need assistance in clarifying your status, uslegalforms can provide helpful resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.