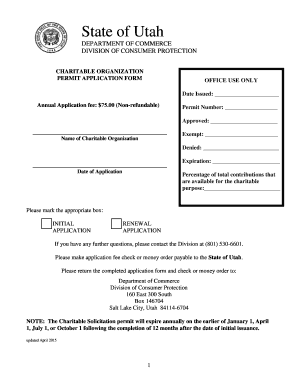

Get Ut Charitable Organization Permit Application Form 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT Charitable Organization Permit Application Form online

Filling out the UT Charitable Organization Permit Application Form online is an important step for charitable organizations seeking to operate legally in Utah. This guide provides clear instructions to ensure your application is completed correctly and efficiently.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to access the application form and open it in your browser.

- In Part I, provide the name of your charitable organization, any other names used, and the organization's physical street address, along with contact details for both the organization and a designated contact person.

- Indicate the applicant's form of business registration by selecting the appropriate checkbox. If applicable, answer whether there are any organizations or persons controlled by or affiliated with you.

- In Part II, specify if your organization is a parent foundation or associated with one. Include the necessary details of the parent foundation if applicable.

- Complete Part III by indicating if your organization uses professional fundraisers or consultants. If yes, fill out the subsequent details, including contact information and contract dates.

- Fill out Part IV regarding any commercial co-ventures your organization plans to utilize, providing relevant names and addresses.

- Part V requests a detailed description of the charitable purpose for the funds being solicited, so ensure this section is comprehensive.

- In Part VI, provide financial information from your latest IRS Form 990 or equivalent. This includes key figures such as contributions and associated costs.

- In Part VII, list the methods of solicitation your organization will use and indicate the projected time frames.

- Part VIII requires disclosure of any legal issues. Answer honestly and provide details if applicable.

- Provide details of your registered agent and organizational structure in Part IX.

- If applicable, answer questions in Part X regarding previous solicitation activities without a permit.

- Finally, in Part XI, ensure the application is signed and dated by an authorized person. Review all parts for completeness.

- Once the form is fully completed, save any changes, and download or print the form for submission along with the required fee.

Complete your application online to ensure compliance and support your charitable mission.

Related links form

While all charities are nonprofits, not all nonprofits qualify as charities. A nonprofit organization can pursue a broad range of activities, but charitable organizations specifically focus on charitable goals, such as education or health improvement. When completing the UT Charitable Organization Permit Application Form, it is important to clearly define your organization’s purpose to effectively classify it as a charity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.